Vuosi

2022

Annual Report and Profit Statement

The Foundation

The Jane and Aatos Erkko Foundation’s primary goal is to promote and support research and teaching in the fields of technology, economics and medicine. Another goal is to promote arts and culture as well as sports and physical education and wellbeing in the interests of the Finnish nation.

The Foundation’s strategy for 2021–2023 underlines the promotion of high-quality research aiming at scientific breakthroughs as well as the advancement of art and culture of the highest international standard. The Foundation seeks to enable long-term projects and increase the share of grants intended for more extensive cutting-edge projects. Additionally, the strategy foresees an increase in technology grants along with medicine, which is already being sponsored on a major scale.

Activities carried out during the reporting period to accomplish the Foundation’s mission

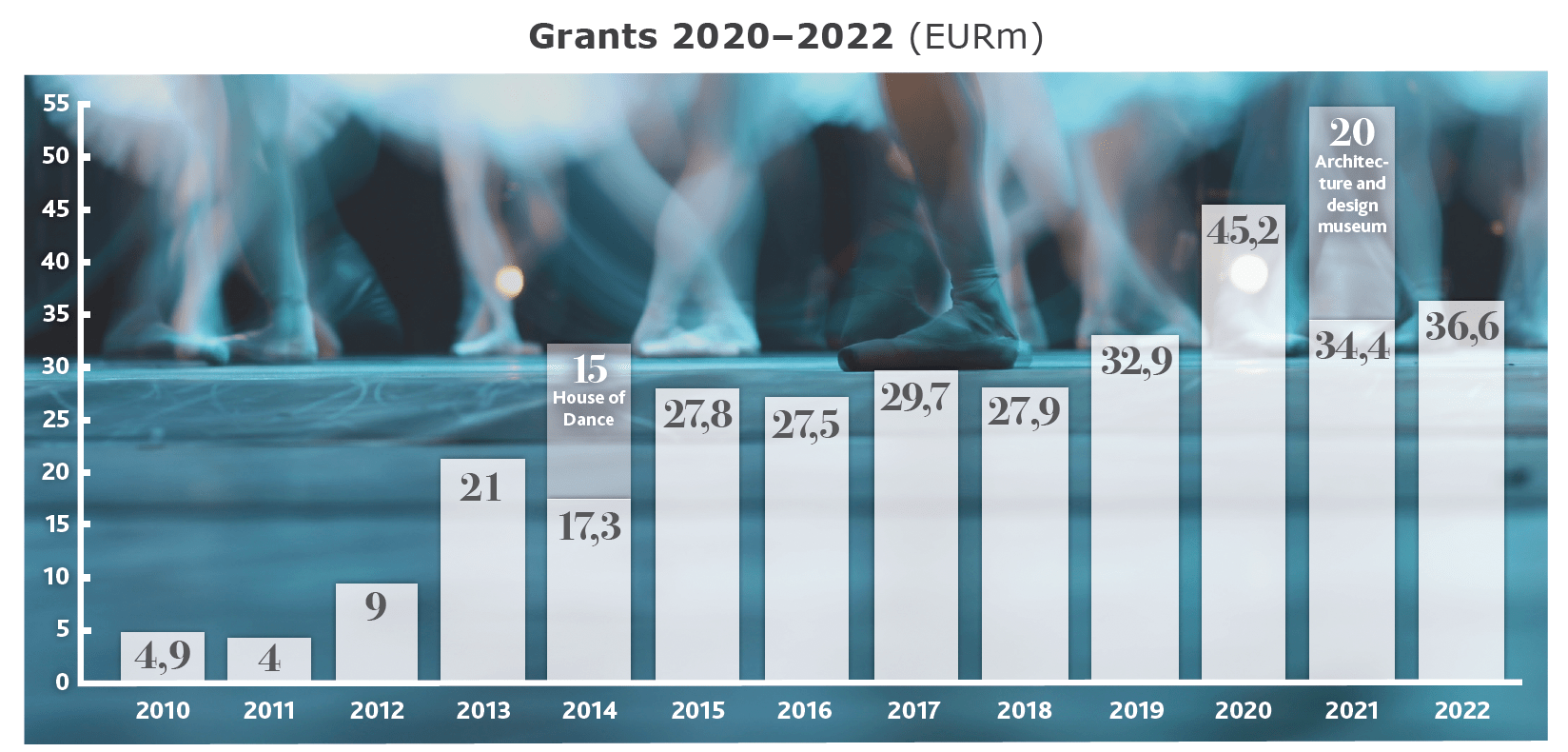

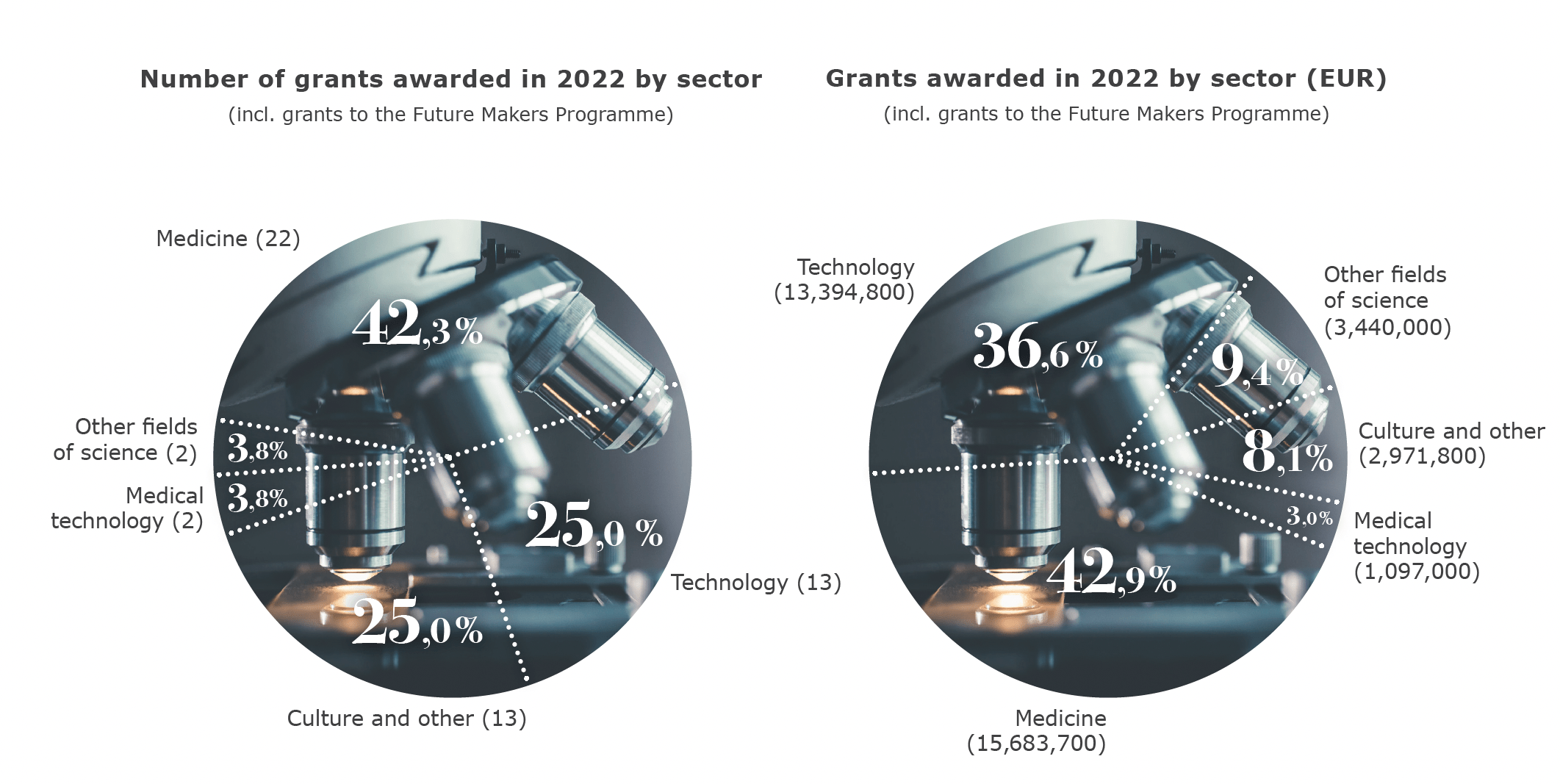

In 2022, the Foundation awarded a total of EUR 36.6 million (EUR 54.4 million in 2021) in grants for science and the arts. In 2021, the Foundation had granted EUR 20 million to the Architecture and Design Museum project, which increased the total amount of support for that year.

EUR 33.6 million was allocated to scientific research, which accounted for 91.9% of the total, while medicine, inclusive of medical technology, received EUR 16.8 million. Grants awarded for technology projects amounted to EUR 13.4 million and the funding provided for other fields of science to EUR 3.4 million. A total of EUR 3 million (8%) was awarded for culture projects.

The approval rate of all grant applications was 13% (13.4%). Extensive, cutting-edge projects reflecting the Foundation’s core objectives (long-term, high-impact projects of EUR 1 million or more) accounted for 25% of the year’s grants.

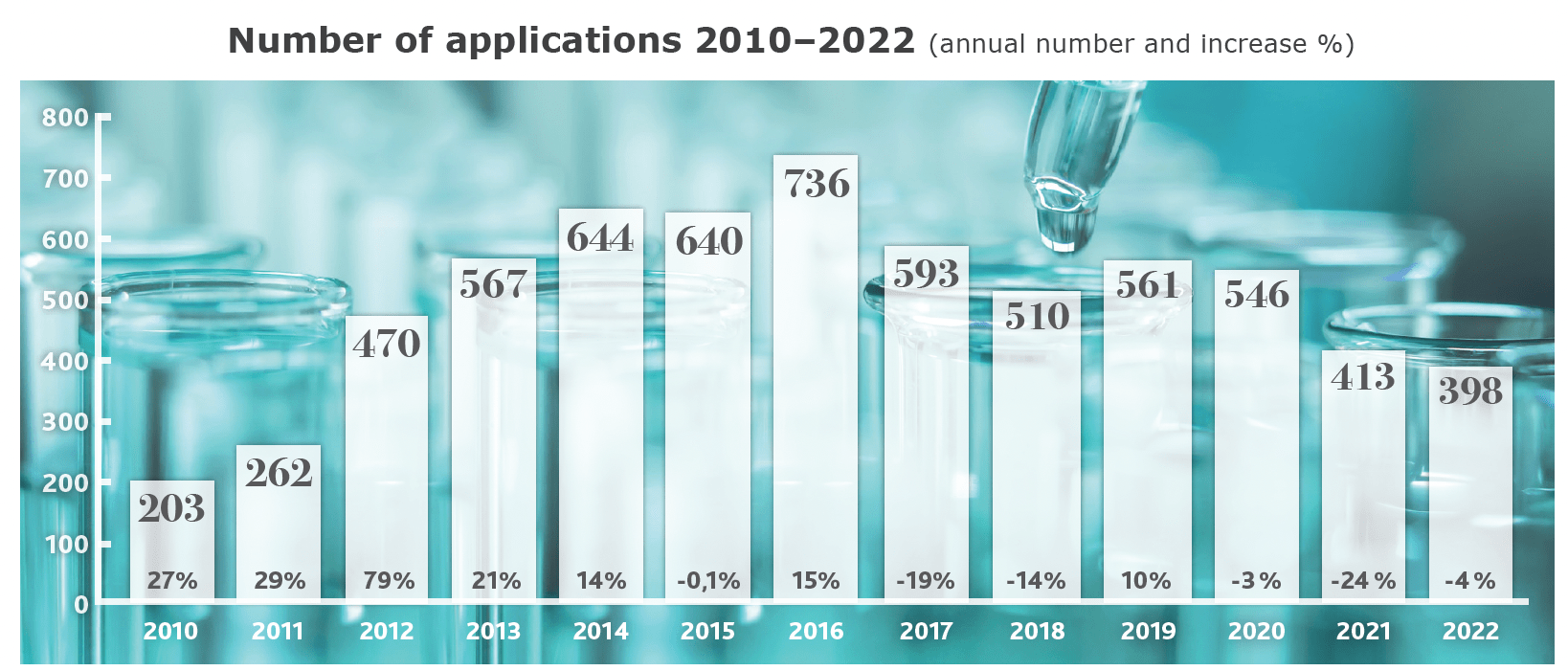

The Foundation observes no fixed application periods since applications are processed throughout the year. As the number of applications related to multidisciplinary and large-scale projects received by the Foundation has been increasing, more resources have been allocated to evaluating these applications. On the whole, the number of applications remained practically the same as in the previous year. The reporting period was characterized by the Covid-19 pandemic and the war in Ukraine that broke out in the spring. The number of change requests related to the intended use of the grants or project timetables was high, but levelled off towards the end of the reporting period. The number of applications for cultural projects did not reach the volumes witnessed in previous years.

The return on investments in 2022, with due regard to unrealised changes in market values, was -20.7% (+17.8%). After three years of excellent returns (2019–2021), 2022 showed a loss. When assessing financial performance, it should be borne in mind that the year-on-year fluctuations in returns are considerable because of the high equity weighting.

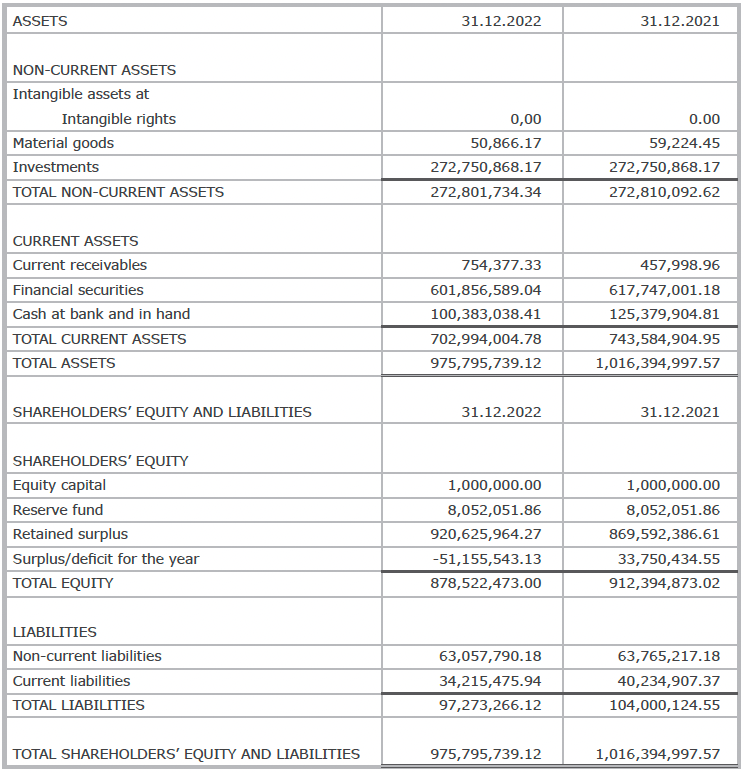

At the turn of the year, the market value of the Foundation’s assets totalled EUR 1,256 million (EUR 1,635m). Of this, equities accounted for 89.3% (91.2%) and fixed-income instruments 10.6% (8.7%).

The deficit for the 2022 financial year was EUR 51.2 million (2021 surplus EUR 33.8m).

Attached to this report is a list of all the grants awarded by the Foundation as well as a summary of the key financial indicators

The Foundation’s grant activities

During the year under review, grants totalling EUR 36.6 million (EUR 54.4m) were awarded to 52 (56) research teams, organisations and individuals. Of the approved applications, 39 (43) were for scientific research and 13 (11) for cultural projects. The Foundation awarded 13 (11) multi-year grants exceeding EUR 1 million and 16 (10) grants ranging from EUR 500,000 to EUR 1,000,000.

The 2022 grant activities are characterised by the Foundation’s long-term grant policy, which also allows for new openings and risky projects.

The total number of applications reviewed by the Foundation in 2022 was 400 (417). The processing of science applications was extended by scheduling the review of medical projects for the March and September meetings and technology projects for the May and December meetings. Applications related to other scientific disciplines and culture projects continued to be reviewed at all meetings.

Projects eligible for financial support were selected in accordance with the Foundation’s purpose as defined in the by-laws and the current strategy. When applications are processed, due consideration is given to disqualification grounds and the impact of potential conflicts of interest on preparation and decision-making.

Other considerations include the Foundation’s financial position, actual returns on investments as well as foreseen returns. Grants are disbursed three times a year (January, May and September). Follow-up on long-term projects was intensified by updating interim and final reporting procedures.

Sponsoring scientific research

The Foundation fulfils its mission by sponsoring research of international standard aiming at scientific breakthroughs. Research in medicine, medical technology and technology is prioritised. Eligible projects may also involve several fields of science or consist of consortia formed by several research communities or universities. In its grants policy, the Foundation favours a payroll scheme that provides social security for the grantees.

Additionally, the Foundation extends Proof of Concept funding for promising preliminary research ideas. Projects aiming at preliminary findings may spawn more extensive programmes or open new avenues of research.

While the Foundation does not sponsor post-graduate students individually, eligible projects may include work related to doctoral dissertations. Hence, the educational impact of the Foundation grants is significant in that they provide employment for doctoral and post doc researchers. One of the Foundation’s goals is also to facilitate the career advancement of young researchers.

Grants are awarded for projects whose scientific significance and impact can be directly assessed by the Foundation Board. The same holds for the Future Makers Programme launched jointly with the Technology Industries of Finland Centennial Foundation.

In preparing the grant proposals, the Foundation relies on external experts who are also involved in other development efforts designed to contribute to the Foundation’s grant activities.

Medicine

Grants awarded for medicine, inclusive of medical technology, accounted for 46% of the total, both in terms of money and numbers. A majority of the awards related to cancer and tumour biology, microbiology, virology, parasitology and immunology, cell and molecular biology, biochemistry and neuroscience, all disciplines with the highest number of applications. The grants focused on basic and translational research. About 25% of the applications were for Proof Of Concept projects, which accounted for about 15% of the granted applications. Regionally, topping the list of grantees are the universities of Helsinki, Turku and Oulu. Nearly half of the applications were related to projects worth more than EUR 500,000, representing about 71% of the grants.

The biggest single grant of the year – EUR 1,636,000 – was awarded to Professor Satu Mustjoki of the University of Helsinki for her year 4-year blood cancer research project. Many blood cancers, such as leukaemias, still have poor prognosis and lead to the death in a matter of years. The project led by Mustjoki seeks to identify more effective immunological therapies for blood cancer patients and to understand the resistance and sensitivity mechanisms between individual patients and cancer types

The 2022 grant awards also recognised the sustained, yet risky, efforts of young researchers, mid-career scientists and team leaders. A case in point is Alexander Kastaniotis, PhD, an academy researcher at the University of Oulu, whose four-year project (EUR 796,000) focuses on the regulation of basic metabolism and the identification of various disorders at the molecular level. A two-year tuberculosis study (EUR 295,000) by Arto Pulliainen, Associate Professor at the University of Turku, aims to identify new potential drugs.

During the year under review, the Foundation, in collaboration with fourteen other foundations providing financing for various fields of medicine in Finland, carried out a survey to map out the overall outlook and development of funding for medical research in this country. On the whole, medical research expenditure remained unchanged, but domestic foundations emerged as the key external financiers of this type of research in Finland. The findings corroborated the Foundation’s 2021 in-house analysis of its operating environment concluding that the amount of funding available to universities for clinical research was declining.

Technology

One of the Foundation’s aims in the current strategy period is to sponsor technology. To achieve this, the Foundation continues its dialogue with universities and researchers engaged in technological research. At the same time, the Foundation carried out a analysis of the current ambience for technology research and education by interviewing a large number of university people.

Measures to improve grant activities will continue in 2023.

Of the applications granted, some 25% were related to technology, representing 37% of total funding. Topping the list were information and communication technology, materials and nanotechnology, as well as energy and environmental technology. Aside from material and nanotechnology, other successful fields included technical physics and biotechnology. Competence-enhancing projects, in particular, emerged as strong contenders in 2022. A total of 45% of the applications and 72% of the approvals related to project packages worth more than EUR 500,000. Geographically, most of the grants went to Aalto University as well as the universities of Tampere and Oulu.

The biggest single grant of the year – EUR 3,000,000 – was awarded to the University of Tampere for the establishment of a new doctoral programme. Man-machine interaction not only offers opportunities but also poses problems. CONVERGENCE is a doctoral programme that seeks to generate a coherent body of knowledge by drawing upon several fields of expertise to ensure a high standard of industrial and social as well as ethical competence. The investment in knowledge capital was also reflected in the Foundation’s EUR 1,500,000 grant to InstituteQ, a joint quantum knowledge hub of the University of Helsinki, Aalto University and VTT. Established in 2021, this organisation promotes national quantum research, education and expertise in commercialisation. The grant will be used to set up a PhD School.

Of the basic research grants, the biggest single tranche – EUR 2,000,000 – went to the Centre for Advanced Steels Research (CASR) at the University of Oulu. This centre of excellence of around 120 researchers is the largest research unit in its field in the Nordic countries, covering the entire steel processing chain. Supported by this five-year grant, the Centre will address topical basic research problems in the field, including steel and engineering industry projects that offer the greatest potential for reducing carbon dioxide emissions and reinforcing the knowledge base.

The Future Makers Programme launched in collaboration with the Technology Industries of Finland Centennial Foundation attracted 34 (89) applications in 2022.

Funding was provided to four projects under the programme, with the Foundation awarding grants to two. One (EUR 650,000) was awarded to Professor Zhipei Sun of Aalto University for a three-year project in spectrometry to develop a miniature high-performance spectrometer with broad application potential at an affordable cost. The other grant (EUR 450,000) under the programme went to Professor Humeyra Caglayan of the University of Tampere, whose three-year project aims to develop microscopes for 3D imaging of living cells by drawing upon the advances in optics and imaging technology.

The programme was closed at the end of 2022.

Other scientific research

Funding for other scientific research amounted to 4% (9%) of the total during the reporting period. In terms of euros, these grants accounted for 9% (14%).

Noteworthy among the year’s grants are projects that not only create something new, but also makes use of the existing research and knowledge resources. Much too often, the harnessing of existing knowledge for useful societal purposes is overlooked.

A case in point is the EUR 1,000,000 grant awarded to the Finnish Academy of Science and Letters to develop a model for promoting the impact and use of research knowledge by and between different academies of science, researchers, policy makers and other stakeholders. As a player representing a wide range of scientific disciplines, the Academy serves as a network for researchers of the highest scientific standard and is in a position to consolidate its role as an impartial disseminator of information.

The five-strong team of the Research Centre for Ecological Change (REC Centre), led by Professor Anna-Liisa Laine of the University of Helsinki since 2018, was awarded a five-year extension grant of EUR 2,440,000. The Centre plays an important role in monitoring and implementing Finland’s biodiversity policy, and is an example of how to combine cutting-edge research with practical solutions.

Culture and the creative sector

The Foundation’s objectives are to raise the cultural and artistic sector to an international level and to support projects that promote wellbeing, skills development and social inclusion. Due consideration is given to the areas of interest expressed by the founders within the limits imposed by the Foundation Charter.

Of all the grants awarded during the reporting period, 25% (20%) were given to art and culture, or 8% (5%) in terms of money. The grants facilitated, among other things, the skills development and training of talented young artists, as well as international competition and cooperation.

Support for training and capacity building included the following grants awarded during the reporting period:

Finnish National Ballet’s Youth Group secured an extension grant of EUR 1,200,000 for the following three years. The Violin, Alto and Cello Academy Association and the Youth Piano Academy Support Association engaged in promoting these instruments were each awarded EUR 100,000 for their activities.

Overview of the projects completed in the reporting period

Steps were taken during 2022 to improve reporting on completed projects to gain a better insight into the use of the grants and improve the Foundation’s understanding of the importance of the projects to the field concerned and the researchers themselves. The educational value of the Foundation’s grants is illustrated, for example, by the number and experiences of doctoral and post-doctoral students. The reports are part of the Foundation’s efforts to keep abreast with the developments in the various sectors, and their potential will be further explored in 2023.

A total of 51 projects were closed in 2022, most of them (29) medical and medical technology projects (worth EUR 18,601,000). Other completed projects included 7 technology projects (EUR 3,798,000), 2 other scientific projects (EUR 1,668,000) and 13 culture projects (EUR 5,792,000).

Projects that made good progress, achieved their objectives or introduced new research approaches also seem to have been successful in attracting follow-up funding, either from the Foundation or elsewhere. The Foundation’s policy is that a research project or other activity is eligible for additional funding if the initial objectives have been met.

Examples of projects completed in 2022 include Professor Maija Vihinen-Ranta’s basic research project on herpes virus at the University of Jyväskylä, initiated in 2018, and an extensive collaboration project between the Universities of Tampere, Kuopio and Helsinki on the development

of the electrical impedance tomography of stroke (Professors Jari Hyttinen, Ville Kolehmainen and Samuli Siltanen), a project launched in 2016. Both teams will continue their work with the aid of new grants awarded by the Foundation. In 2019, Heikki Ruskoaho, PhD, University of Helsinki, succeeded in his high-risk Proof of Concept project for personalised treatment of acute leukaemia, and further funding for drug development has been secured elsewhere. In 2014, the Foundation granted EUR 15 million to the Tanssin Talo (House of Dance) project.

The construction project was completed on schedule, and the official inauguration was celebrated on 2 February 2022. The Finnish Broadcasting Company recorded and broadcast the opening ceremony live from the Erkko Hall named after the Foundation. The grant was given to finance the construction of the new wing, which had been completed earlier by Koy Kaapelitalo.

Finances of the Foundation

The Foundation’s assets have accumulated gradually following the infusion of the initial capital by the founders in 2002 and substantial testamentary bequests received in 2012 and 2014.

At the end of 2022, the market capitalisation of the Foundation’s assets stood at EUR 1,256 (EUR 1,635m) consisting of a directly held securities portfolio of EUR 234 million (EUR 270m); shares held in Sanoma Plc valued at EUR 391 million (EUR 542m); housing company shares valued at EUR 1 million; and Asipex Group’s securities portfolio of EUR 630 million (EUR 817m).

The Foundation’s wholly owned company Oy Asipex Ab is based in Helsinki and it has a wholly owned Swiss subsidiary Asipex AG. By the end of 2022, the Foundation had approved but not yet disbursed grants in the amount of EUR 95.9 million. At the end of 2022, equities accounted for 89.3% (91.2%), fixed-income investments 10.6% (8.7%) and housing company shares 0.1% (0.1%) of the Foundation’s total assets.

Group

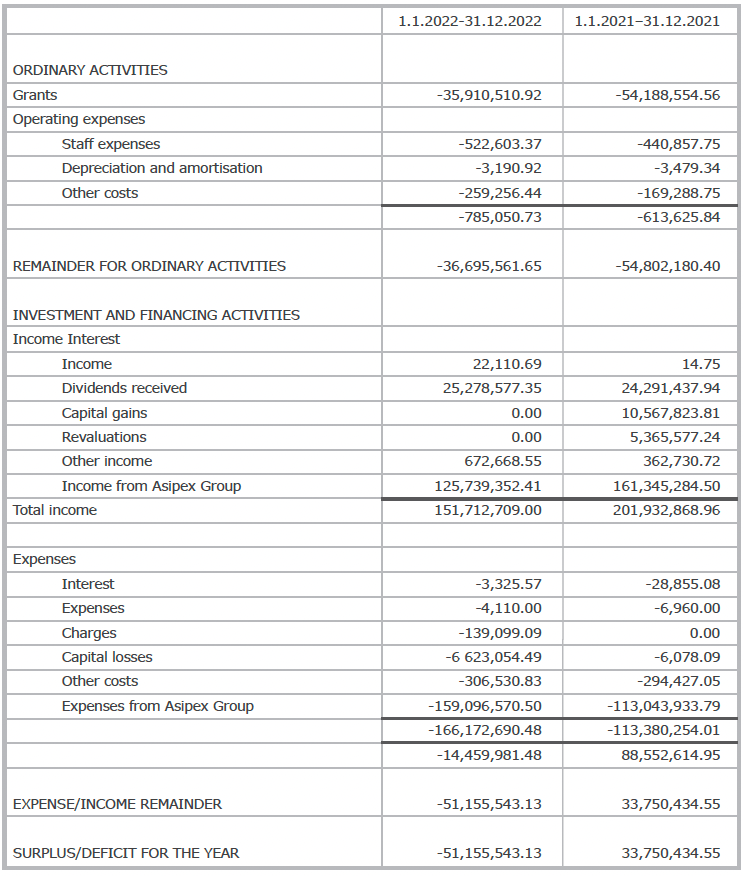

The remainder of actual activities was EUR 36.7 million (EUR 54.8m). Grants awarded during the reporting period amounted to EUR 36.6 million (EUR 54.4m). Total grants recognised for 2022 were EUR 35.9 million (EUR 54.2m). The difference between awarded and recognised grants is due to returns of unused grants and withdrawn grants. Other operating expenditure amounted to EUR 0.8 million (EUR 0.6m).

The book return on the investments held by the Foundation were EUR -14.5 million (EUR 88.6m). Of this, the net return earned by the subsidiary group was EUR -33.4 million (EUR 44.1m); return on dividend income EUR 24.5 million (EUR 23.35m); depreciation and impairment on equities and funds EUR 6.1 million (revaluations EUR 5.4m); sales proceeds on investments EUR -0.1 million (EUR 10.6m); fund profit participations EUR 0.8 million (EUR 0.8m); interest income and expenditure EUR 0.0 million (EUR -0.0m); and other financial income and expenses EUR 0.4 million (EUR 0.1m).

The deficit for the 2022 financial year was EUR 51.2 million (2021 surplus EUR 33.8m).

Parent foundation

The deficit of the parent foundation in the financial year 2022 was EUR 17.8 million (deficit EUR 14.6m).

Board fees and the Agent’s salary subject to withholding tax totalled EUR 325,868 in 2022.

Board members were paid a monthly fee as well as meeting fees for service on the Board and Committees. The fee of the Chair of the Board was EUR 2,000 per month and that of the members EUR 1,500 per month. Chairs of the Board and Committees received a meeting fee of EUR 600 and members EUR 500 per meeting. Board members’ work is not limited to meetings.

Aside from the auditors’ fees, the Foundation had no transactions between related parties, for consideration or otherwise. Nor did the Foundation extend any loans or give any guarantees for and on behalf of related parties.

2022 was a difficult year in the financial markets: in a nutshell, interest rates rose and share prices fell. Inflation was surprisingly high as job markets tightened and commodity prices rose significantly following Russia’s invasion of Ukraine. To curb inflation, central banks raised interest rates aggressively, which quickly tightened the financial markets and led to a global slowdown.

In equities, price movements in the main indices were well above normal during the year and returns turned clearly negative by the end of 2022; however, in euro terms, returns across the various market areas were ultimately more or less identical. The least negative performance was put in by developed markets led by Europe, whereas the emerging markets and Asia generated the lowest returns.

In euro terms, including dividends, the MSCI World AC index returned -13% (+28%), the MSCI Europe index -8% (+25%), the SP500 index -13% (+38%), the OMXH Cap index -13% (+25%), the Nikkei index -14% (+4%) and the MSCI Emerging Market index -15% (+5%).

The return on the Foundation Group’s investments in 2022, with due regard to unrealised changes in market values, was -20.7% (+17.8%). The diversified equity portfolio (excluding Sanoma) gave a return of -21.3% (+32.5%), which falls short of market returns at equivalent geographical allocation by a wide margin. The return on Sanoma shares was -24.7% (+2.7%). At the end of the reporting period, the ten-year total return on the equities held by the Foundation was still excellent, approx. 10% p.a. Annual returns may vary greatly due to the high equity weighting.

The Foundation holds 39,820,286 shares in Sanoma Plc, representing 24.35% of the aggregate

of shares and voting rights in the company.

The total return on Sanoma Plc shares inclusive of unrealised changes in value was -24.7%

(+2.7%). The dividends paid by Sanoma Plc to the Foundation in 2022 amounted to EUR 21.5

million (EUR 20.7m).

The Foundation invests its assets responsibly with due regard to not only financial considerations

but also environmental, social and governance criteria. The definition, regulation, reporting

and measurement of sustainability performance are still being developed. Hence, the Foundation believes that responsibility should be approached holistically from several angles.

The Foundation monitors the responsibility and impact of its portfolio in terms of the 17 objectives

set out in the UN Agenda 2030 (Sustainable Development Goals, SDG). Investments are avoided

in companies whose business is substantially based on alcohol, tobacco, arms or gambling.

The Foundation regularly monitors the sustainability performance of its investment portfolio.

For several years now, it has also carried out a comprehensive sustainability analysis of

the portfolio in consultation with a partner. The 2022 analysis covered more than 90% of the

Foundation’s total assets and virtually the entire equity portfolio. According to the analysis,

the sustainability of the Foundation’s investment portfolio has consistently improved relative

to previous years, outperforming or at least meeting the benchmark index (MSCI World) on

all operational indicators.

The analysis showed that the Foundation’s portfolio had more positive theme exposures and

fewer negative or ambiguous themes than the benchmark index. Compared to the benchmark

index, positive theme exposures were particularly strong in the pharmaceutical industry and

health technology, as well as education and publishing due to the interests held in Sanoma.

However, the Foundation also invests in a few companies with negative thematic exposure,

such as industry leaders in the transition towards a low-carbon society. Overall, the carbon

footprint of the Foundation’s portfolio was 66%, and the weighted carbon intensity was 68%

lower than the benchmark index. Even without the Sanoma shares, the figures would have

been 40% lower than the benchmark index.

Risk management

The Foundation lives off its investment assets, and its operations are established on a permanent footing. Risk management by the Foundation is governed by sound and transparent corporate governance procedures and clear-cut internal processes. The most significant risks are related to asset management and market risks as well as the price and anchor shareholder risk associated with Sanoma Plc holdings and potential reputational risks arising from sponsorship.

To respond to the needs of a changing society and reduce the vulnerability its small organisation is exposed to, the Foundation regularly assesses and updates its core processes, policies and job descriptions.

In both its sponsoring and investment activities, the Foundation monitors current developments and participates in a range of events while carrying out its own analyses, when appropriate, to keep up with the evolving operating environment and identify potential social and reputational risks. Aside from the annual analysis of the sustainability performance of its portfolio, the Foundation conducted a study on the theme of the green transition in the context of investment activities.

The primary goal of the investment activities is to protect and increase the real value of the assets in the long term. Other objectives include a steady cash flow and adequate liquidity needed to ensure the continuity of core activities. Given the Foundation’s long investment horizon, the assets are invested mostly in equities (weighting 89.3% at the end of 2022), and hedging is normally not used. Short-term fluctuations in share prices are unimportant to the Foundation because it seeks a healthy real return and steady cash flow in the long run. Normally, annual returns fluctuate sharply.

Asset management and investments have been carried out in accordance with the investment policy adopted by the Board, and matters related to investment activities have been reviewed by the Foundation’s Financial Committee.

In accordance with the Foundation’s strategy, investments are diversified in terms of geographical area, line of business, companies and currencies. Most of the investments are made in liquid securities and fund units that can be quickly converted into cash, which means that the Foundation’s exposure to financial and liquidity risks is extremely low. ESG criteria are incorporated into the investment and risk management policies.

The state of the economy in Finland and internationally is reflected in the Foundation’s investments. The risks are primarily related to the general market risk, i.e., the movements in the international stock market and dividend income in the long term.

Additionally, some 31% of the Foundation’s assets consist of shares held in Sanoma Plc, which poses the biggest single price risk.

The investment activities and risk management of the Asipex Group are conducted in accordance with the investment policy adopted by Asipex’s Board of Directors, which, in turn, is in line with the investment policy pursued by the Jane and Aatos Erkko Foundation.

Communications

The Foundation seeks to be transparent, clear and up-to-date in its communications.

The primary channel of communication is the Foundation’s website. The site offers extensive information on matters such as the Foundation and its activities, including the grant application process and assessment criteria.

An important part of the communications are the Foundation Agent’s personal meetings with the governing bodies of universities and faculties as well as researchers and cultural actors. The decisions on grant awards are posted on the website and published in a news release as soon as possible after Board meetings. The list of grants is updated with regard to projects whose implementation is pending. The grounds for approving or rejecting grants are not publicised, nor are the names of the external advisers disclosed.

Any material changes in the Foundation’s activities, financial position and administration are communicated as appropriate. All the releases are found in the Foundation’s ePress newsroom. The latest releases are also available on the website. In 2022, the Foundation started publishing both newsletters and articles. The articles explore topical issues related to the Foundation’s grant activities.

Data protection and document management

When submitting applications for funding or grants to the Jane and Aatos Erkko Foundation, the applicants disclose personal information, which creates a personal data file for the Foundation. The Foundation has used its best efforts to put in place a transparent procedure in which the rights of the applicants are duly considered as required under the Data Protection Act.

Administration

The Annual General Meeting held on 28 March 2022 appointed Nils Ittonen Chair of the Board and Juhani Mäkinen Deputy Chair.

Marianne Heikkilä, Reetta Meriläinen, Mikko Mursula, Jussi Pesonen, Sari Pohjonen, Kerstin Rinne and Antti Vasara were appointed members of the Board.

The term of every board member ends at the following General Annual Meeting. During 2022, the Board convened five times; however, the Board also addresses foundation business at other times outside meetings.

At the General Annual Meeting, the Board appointed Mikko Mursula Chair of the Financial Committee with Nils Ittonen, Hanna-Mari Peltomäki and Karl Tujulin nominated as members.

The Financial Committee monitors the financial market and general economic developments acting within the framework of the investment strategy adopted by the Board. The Financial Committee convened four times during the reporting period.

At the General Annual Meeting, the Board appointed Nils Ittonen Chair of the Working Committee, while Juhani Mäkinen and Hanna-Mari Peltomäki were appointed members.

The Working Committee prepares matters for presentation to the Board. The Working Committee convened four times during the reporting period.

At the General Annual Meeting, the Board appointed Antti Vasara Chair of the Expert Committee, while Nils Ittonen and Hanna-Mari Peltomäki were appointed members. The Expert Committee convenes when necessary. The names of the experts are not disclosed.

The Jane and Aatos Erkko Foundation is a member of the Association of Finnish Foundations. The purpose of the Association is to look after the common interests of Finnish grant foundations, funds and societies as well as to promote and develop corporate governance practices and professional skills.

During the reporting period, the Foundation employed an average of seven people of whom four worked for the subsidiary group.

Additionally, job descriptions were defined in more detail and applications were invited for a new position (planner) created in the organisation. The candidate appointed is Henri Kähönen, M.A., who assumed his new duties on 1 February 2023.

The key success drivers in the Foundation’s operations are a qualified and motivated staff, a committed Board and an extensive network of select partners.

At its annual meeting of 28 March 2022, the Foundation Board appointed PricewaterhouseCoopers Oy as the auditor of the Foundation’s accounts, with Valtteri Helenius, APA, serving as the auditor-in-charge.

Activities in the current year

The Foundation fulfils its mission by sponsoring research of international standard aiming at scientific breakthroughs, including art and culture capable of meeting exacting international criteria.

During the 2021–2023 strategy period, the objectives is to gain a deeper understanding of the operating environment and to develop the Foundation’s application and reporting systems and communication tools to better meet its operational objectives. The decision of Sanoma Plc’s Board of Directors to cut dividends will have a negative impact on the Foundations cash flow.

The goals for 2023 are to introduce an electronic evaluation system and update the Foundation’s expertise in view of the next strategy period. Additionally, we will continue to develop ways of harnessing the information provided by the updated search and reporting system, including other sources of data related to the operating environment. The planner recruited by the Foundation at the end of 2022 will focus on the modelling and further development of the ways to exploit data.

The primary communication tool is the website, which will be updated during 2023 to better respond to current needs. The Foundation publishes articles on topical issues, as well as bulletins and newsletters four times a year. The Foundation participates in stakeholder events targeting grant applicants.

The Foundation Agent was appointed to the Board of the Association of Finnish Foundations for the 2023–2024 term.

Profit and loss account

Balance sheet