Vuosi

2024

Annual Report and Profit Statement

The Jane and Aatos Erkko Foundation’s primary goal is to promote and support research and teaching in the fields of technology, economics and medicine. Another goal is to promote arts and culture as well as sports and physical education and wellbeing in the interests of the Finnish nation.

Foundation

The Jane and Aatos Erkko Foundation fulfils its mission by supporting high-quality research of international standard aiming at scientific breakthroughs, art and culture. Scientific grants are primarily targeted at medicine and technology as well as natural sciences supporting the aforementioned fields. The Foundation does not single out any specific priorities or themes for its grant activities in the field of art or science.

When deciding on grants, special attention is paid to the significance of the projects in their respective fields and their potential to achieve a breakthrough.

Grants are primarily granted to working groups and organisations with demonstrated ability or potential to renew their field. The Foundation uses the Proof of Concept grant form for projects that contain promising or preliminary ideas and, if successful, can lead to new scientific discoveries.

External experts are consulted in the preparation of decision proposals, and they also participate in other development work promoting the Foundation’s grant activities. Due consideration is given to the areas of interest expressed by the founders within the limits imposed by the Foundation Charter.

The primary goal of the Foundation’s investment activities is to preserve and increase the real value of its assets in the long term. The investment strategy is equity-heavy. The goals include stable cash flow and sufficient liquidity to ensure the continuity of core activities.

Short-term price fluctuations are not significant for the Foundation. All grant decisions are made with due regard to the Foundation’s financial position. Grants are disbursed three times a year (January, May and September). The Foundation’s operating principles include interaction and flexibility as well as the active development of the Foundation’s work. The Foundation operates responsibly in all areas of its operations.

Fulfilment of the Foundation’s mission

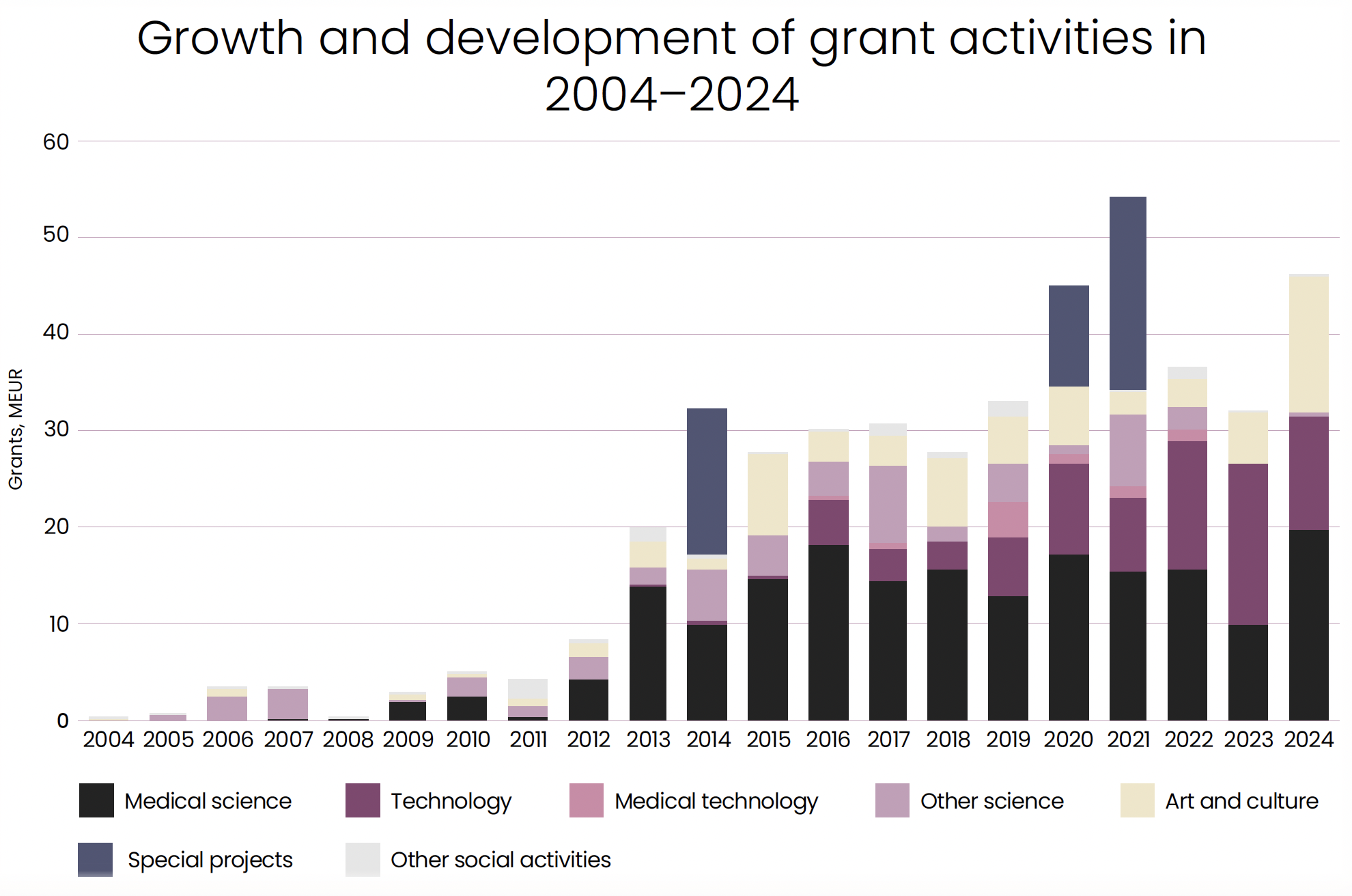

In 2024, the Foundation awarded EUR 46.3 million (2023: EUR 32.0m) in grants for science, arts and culture.

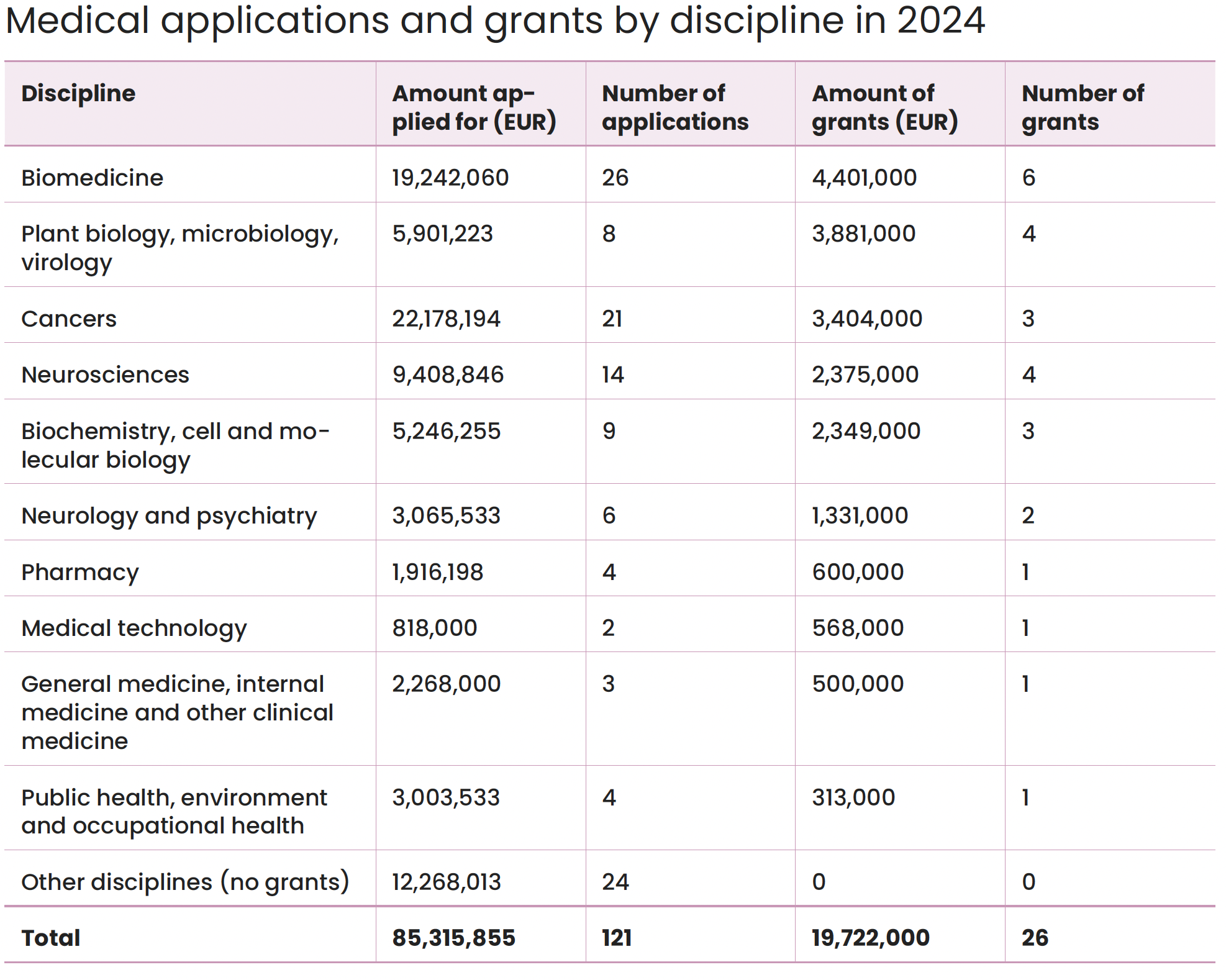

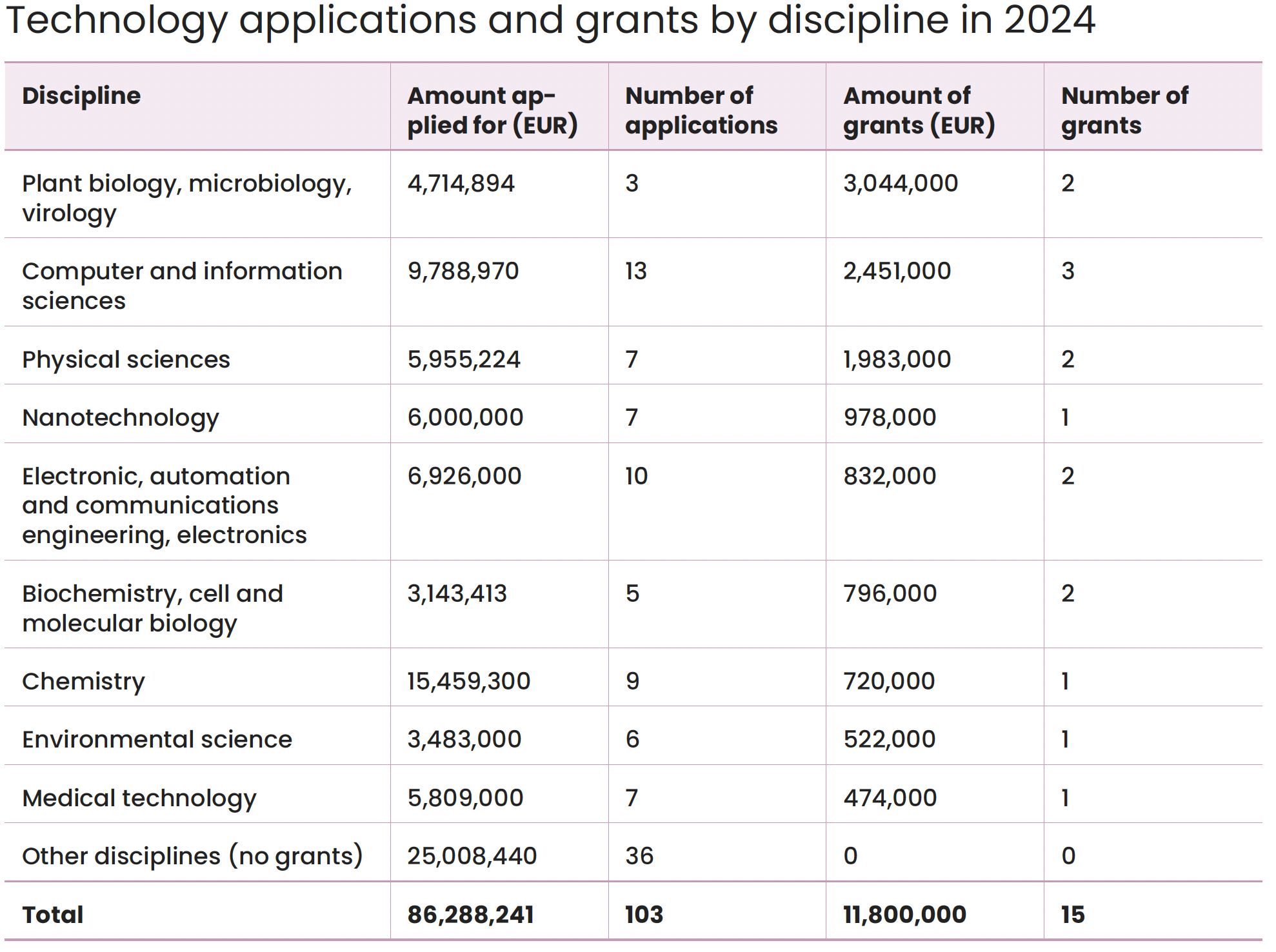

EUR 31.9 million (EUR 26.6m) was allocated to scientific research, which accounted for 68.9% (83.2%) of the total. Medicine received EUR 19.7 million (EUR 10.1m). Technology grants amounted to EUR 11.8 million (EUR 16.6m). Other science grants amounted to EUR 0.4 million (EUR 0.0m). The medicine and technology grants also include projects related to natural sciences.

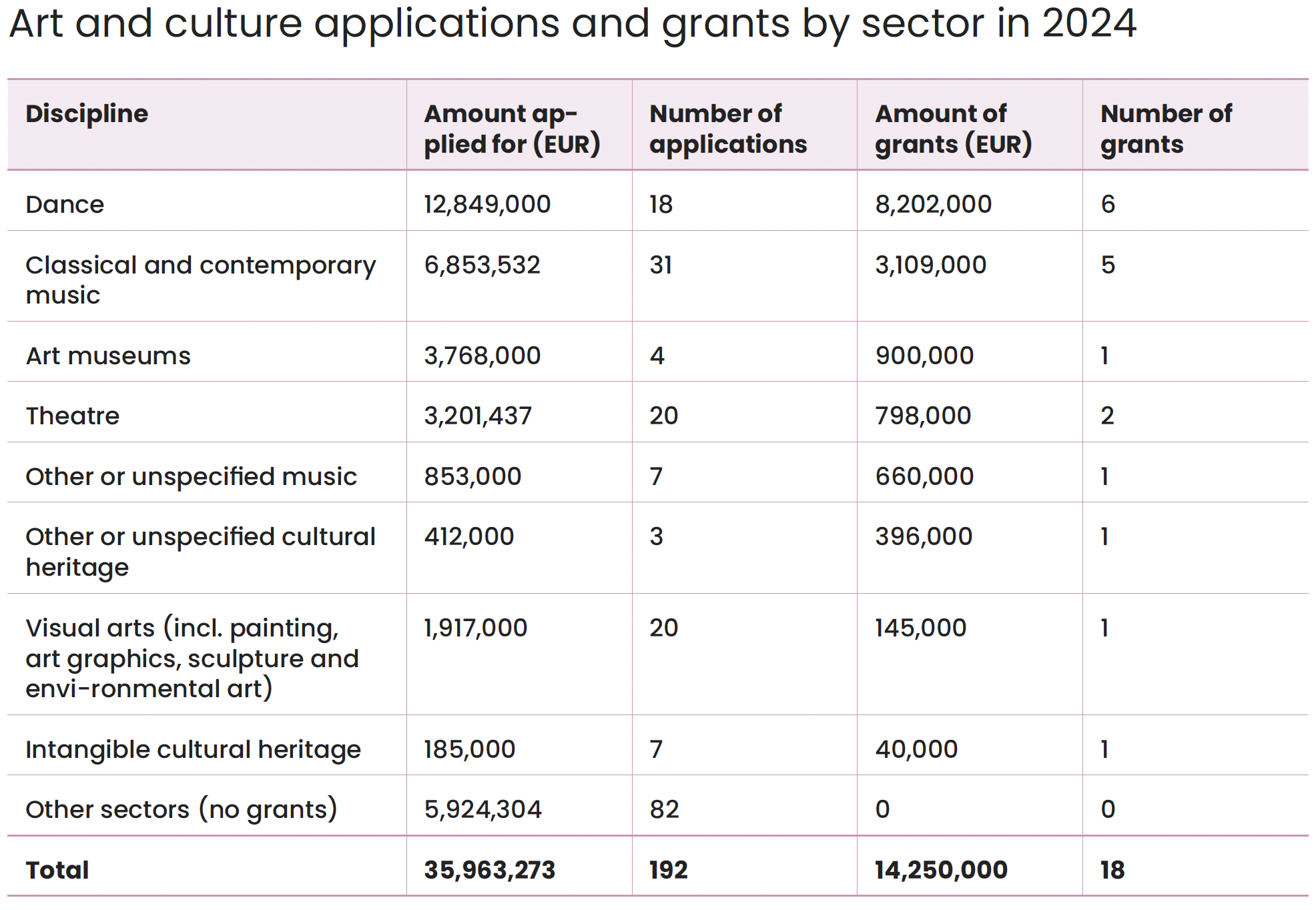

EUR 14.3 million (EUR 5.4m) was allocated to arts and culture projects, which accounted for 30.9% (16.8%) of the total of grants awarded during the year. EUR 0.1 million (EUR 0.03m) was awarded to other societal activities.

The approval rate of all grant applications was 12.7% (11.3%). In terms of euros, the approval rate was 20.1% (17%).

Extensive projects (long-term, high impact projects of EUR 1 million or more) accounted for 23.8% (14%) of the year’s grants.

The Foundation has no specific application periods and applications are processed throughout the year. The number of applications received during the year (495) decreased by 2.2% relative to the previous year (506). The Foundation continued the processing of science applications with the rotation of reviewing the medical projects for the March and September and technology projects for the May and December board meetings. Applications related to other scientific disciplines and culture projects continued to be reviewed at all board meetings.

The processing of applications took into account issues of disqualification and the impact of any conflicts of interest on preparation and decision-making.

The return on investments in 2024, with due regard to unrealised changes in market values, was +13.0% (+1.3%). The Sanoma Plc shares returned +16.5% (-26.7%) and other investment assets +12.1% (+14.2%).

At the turn of the year, the market value of the Foundation’s assets totalled EUR 1,351 million (EUR 1,232m). Of this, equities accounted for 93.5% (91.1%) and fixed-income instruments 6.4% (8.8%). The surplus for the 2024 financial year was EUR 11.5 million (surplus EUR 36.2m).

The Foundation’s grant activities

The Foundation’s grant activities vary naturally from year to year. It follows the application pressure. In some years, special projects significantly increase the total amount of grants. The Foundation has a continuous application process and no separate application periods or programmes are in place. Grants for 2024 increased by 44.7% year-on-year.

In addition to its primary scientific disciplines, the Foundation has also supported other disciplines, such as natural sciences. The image on the next page illustrates the development of grants by discipline.

Projects in natural sciences, agriculture and forestry and other scientific disciplines with a clear connection to medicine or technology are mainly considered part of the Foundation’s grant activities in the fields of medicine and technology in the statistics. Similarly, projects with less of a connection to the Foundation’s main disciplines are included in grant activities for other sciences.

Based on the discipline-related information reported by the applicant, 34 per cent of the grants in 2024 (EUR 15.7 million in total) belonged to natural sciences. The total grant amount for natural sciences is included in the medicine and technology grants in the figures reported in the Annual Report.

The Foundation awards grants primarily to working groups and organisations.

Eligible projects may involve several fields of science or consist of consortia formed by several organisations or universities. The Foundation does not award personal grants for doctoral or post-doctoral projects.

However, research within broader projects is usually carried out by early-stage researchers. Hence, the educational impact of the Foundation grants is significant in that they provide employment for doctoral and post-doc researchers.

During the year under review, grants totalling EUR 46.3 million (2023: EUR 32.0m) were awarded to 63 (57) research teams, organisations and consortia.

Of the approved applications, 43 (42) were for scientific research and 18 (15) for cultural projects. Two grants (2) were awarded for other societal activities.

Most of the grants went to research teams at the University of Helsinki, Tampere University and Aalto University. Plant biology, microbiology and virology, biomedicine and cancers were emphasised among the disciplines receiving grants. In the arts and culture, dance and classical and contemporary music were emphasised.

A total of 15 (8) grants in excess of EUR 1 million were awarded for extensive multi-year projects and 25 (14) grants for projects with budgets ranging from EUR 500,000 to EUR 1,000,000. The median amount applied for increased compared to previous years in all disciplines supported by the Foundation. The median amount of grants awarded was EUR 650,000.

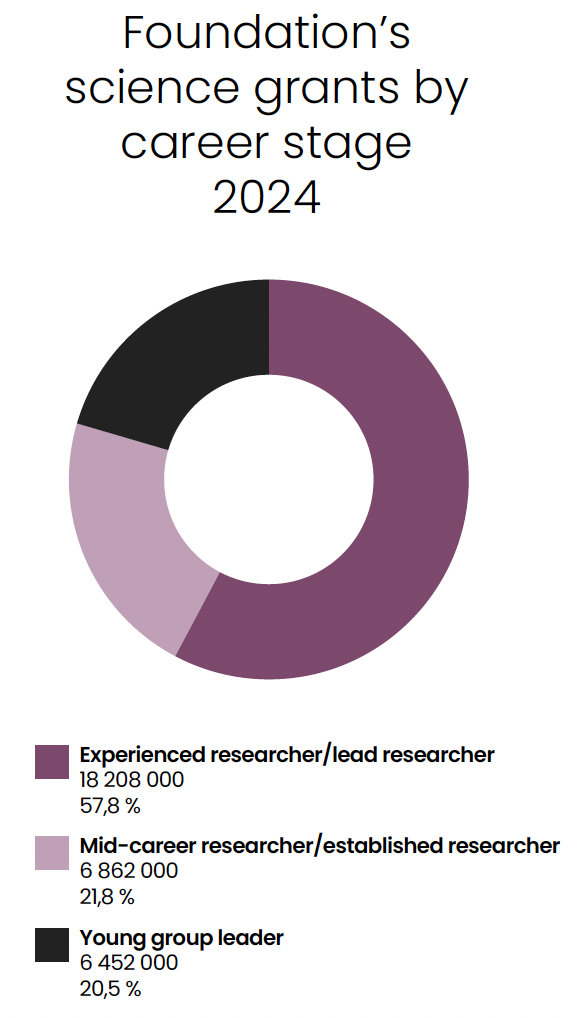

During the year under review, special attention was paid to the working conditions of young and intermediate-stage researchers alongside experienced researchers.

For young researchers, the Foundation requires a sufficient level of independence, which is typically considered to be the stage of establishing one’s own research team.

The combined share of young team leaders and intermediate-stage researchers in the grants awarded by the Foundation, 42 per cent, was slightly higher than their share of the total amount of applications received by the Foundation (37 per cent).

The Foundation has only compiled statistics on applicants’ career phase data since 2023, so sufficiently extensive comparative data on the development of applications and grants by career stage will only be available after the 2024–2026 strategy period.

The figure shows the distribution of grants by career stage in 2024.

Promotion of science

EUR 31.9 million (EUR 26.6m) was awarded to science, which is 68.9% (83.2%) of the total grant amount for the year. In accordance with the Foundation’s strategy, the grants were mainly allocated to research in medicine and technology as well as the natural sciences that enable and support them.

In terms of the number of applications, the share of technology reached the level of medicine. Key assessment criteria included the promotion of ‘high risk–high gain’ research, the broader relevance of the project as well as the quality and feasibility of the project plan.

Medicine

The Foundation’s grants for medical research increased to a record-high level during the year, to nearly EUR 20 million (2023: EUR 10m).

Medicine accounted for 41.3% of the number of grants awarded and 42.6% of the amount granted. The University of Helsinki received 56.5% of all medical grants from the Foundation in 2024. The university’s share of medical applications was 33.2%.

Grants for medicine also included natural science projects that support medical research. For example, the research team led by Professor Juha Huiskonen and Senior University Lecturer Minna Poranen at the University of Helsinki was awarded a grant of EUR 820,000 for three years of structural biological research on double-stranded RNA viruses, the aim of which is not only to model the life cycle of viruses, but also to enable new biotechnological applications and plant protection strategies.

The largest medical grant of the year (EUR 1,680,000, 4 years) was granted to a research consortium led by Professor Sarah Butcher of the University of Helsinki together with Professor Varpu Marjomäki of the University of Jyväskylä and docent Minna Hankaniemi of Tampere University. The consortium’s COMBATVIRUS project develops safe, broadly acting antiviral drugs and vaccines.

Coronaviruses and enteroviruses have caused several serious epidemics in the last 20 years, which have put a considerable burden on health care and the national economy. The grant awarded now was preceded by the Foundation’s PoC grant awarded to Marjomäki and Butcher. Its results were promising in the production of significant antiviral molecules and the investigation of their infection mechanisms.

Finland’s strong heritage in cancer research was also reflected in the applications addressed to the Foundation. Alongside biomedicine, cancer research received the largest volume of applications in terms of amounts applied for and number of applications.

Topical themes include the activation of the body’s own defence system as part of treatment and individualised treatment based on the characteristics of the tumour. A joint project by young team leaders, Academy researcher Saara Ollila and Academy researcher Jaakko Mattila, at the University of Helsinki (EUR 904,000, 4 years) focuses on better understanding the mechanisms of the second most common cancer in Finland, colorectal cancer, in order to develop treatments.

Professor Olli Kallioniemi was awarded a Brain Gain grant of EUR 2,500,000

for research in artificial intelligence in medicine.

The Foundation’s share of the co-funded five-year grant is EUR 1,000,000. Kallioniemi will establish a research team at the University of Helsinki’s FIMM – Institute for Molecular Medicine Finland gradually during 2024–2025.

The Brain Gain grant is a joint programme of the Finnish Medical Foundation, the Sigrid Juselius Foundation and the Jane and Aatos Erkko Foundation, which aims to bring experienced internationally acclaimed top Finnish medical researchers back to Finland. The Foundation participated in the first pilot programme carried out in 2023–2024.

Technology

Of the grants awarded, EUR 11.8 million were related to technology, representing 25.5% of total funding. Aalto University’s share of technology grants was 30.2% and the University of Helsinki’s 29.8%.

Grants for technology also included natural science projects that enable and support technology research.

For example, the working group led by Academy researcher Katharina Kujala of the University of Oulu was awarded a grant of EUR 1,045,000 for a three-year plant biology project aimed at changing our current understanding of the role of rare earth metals in microbial metabolism and producing new information that can be utilised in the future in the development of technology for the biomining of rare earth metals.

The largest scientific grant of the Foundation during the year (EUR 1,999,000, 4 years) was granted to a research team led by Professor Yrjö Helariutta of the University of Helsinki. The project, which focuses on birch genetics and diversity in Finland, promotes a better understanding of the adaptation and evolution of forest trees and thus strengthens forest and climate change research internationally.

In addition to projects for a more sustainable future, the grants allocated to technology research emphasise topical themes that are widely discussed in society, such as artificial intelligence and quantum research.

Professor Mikko Möttönen’s work in both theoretical and experimental research in quantum physics is internationally acclaimed. With a three-year grant of EUR 1,500,000, Möttönen’s research team at Aalto University is aiming to achieve a breakthrough in the development of an autonomous quantum processor. If successful, the project may lead to the development of new technology and strengthen Finland’s competitiveness at the forefront of the field.

The EVIL-AI project of Henri Pirkkalainen, Professor at the Tampere University

(EUR 1,413,000, 4 years), focuses on the negative effects of artificial intelligence and the identification and prevention of unethical or criminal activities. Using AI safely requires managing its negative effects. Among other things, the project investigates and creates risk scenarios for encounters between humans and AI agents, from virtual reality to the physical world. The project is novel research aimed at cutting-edge multidisciplinary research.

Associate Professor (tenure track) Alexander Jung and his team at Aalto University are developing a new mathematical method to increase the trustworthiness of federated learning. His research can prove useful in a wide range of applications. Machine learning is used in job search and music applications, for example. A total of EUR 498,000 was granted for the four-year project.

Culture and other grant activities

EUR 14.3 million (EUR 5.4m) was allocated to arts and culture projects, which accounted for 30.9% (16.8%) of the total of grants awarded during the year. Culture-related applications accounted for 38.8% of the total in terms of number of applications, and approximately 15.6% in terms of the amount of euros.

The grants awarded highlighted operating models and content that renew the organisations’ own activities. The cross-cutting themes were internationalisation, skills development and inclusion.

Key criteria in the evaluation included the skills and competence of the applicants as well as the feasibility and relevance of the projects to the sector involved.

The Foundation’s grants for music education are building the future: The Instrument Academies were granted EUR 1,234,000 for four years, the The University of the Arts Helsinki Sibelius Academy EUR 1,000,000 similarly for four years and the Association of Finnish Conservatories EUR 660,000 for two years.

The projects address the current and near future problems of the music industry and education, such as internationalisation, multiculturalism and equality, technological development and the adequacy, accessibility and quality of education for talented young people.

Both Svenska Teatern (EUR 301,000) and Oulu City Theatre (EUR 497,000) are tackling the root causes and obstacles that slow down the diversification of theatres in their three-year projects. Development work that cross-cuts the operations of theatres responds to a societal need and promotes sustainable change in operating methods in the sector. An accessible and diverse theatre serves both theatres and audiences better.

Overview of the projects completed in the reporting period

A total of 63 projects were completed during the year. The highest number of completed projects was in medicine, 30 projects (EUR 19,723,600), followed by technology projects with 22 completed projects (EUR 10,273,180). Eight completed art and culture-related projects were reported (EUR 1,961,500). Three projects in other disciplines were completed (EUR 6,900,000). The completed projects were primarily scheduled to take place in 2019–2023.

The final reports are submitted to the Foundation within six months of the end of the project. The Foundation also monitors some projects more closely throughout their duration.

These include, for example, projects that are deemed to be of significant relevance to their sector. The information is used in the Foundation’s strategy work in assessing the impact of the Foundation’s grant activities.

Projects that achieved their objectives and introduced new research approaches, for instance, are successful in raising follow-up funding, either from the Foundation or elsewhere.

The Foundation’s policy is that a research project or other activity is eligible to apply for additional funding if the initial objectives are met.

Ten projects completed during the reporting period were awarded follow-up funding from the Foundation.

For example, the project of Professor Yrjö Helariutta that received the largest grant in the Foundation’s year of operation uses technology previously developed by the research team to survey the Finnish tree population, observe tree growth and create globally unique genome data.

Helariutta’s previous grant from 2019 Puiden hiilinieluefektin molekulaarinen perusta ja jalostus (EUR 1,000,000) was reported during the year of operation. The results of the project are a valuable source of information for further research, plant breeding and nature conservation biology. The new grant supports the group’s long-term work in a research area where Finland plays an internationally significant role.

Finances of the Foundation

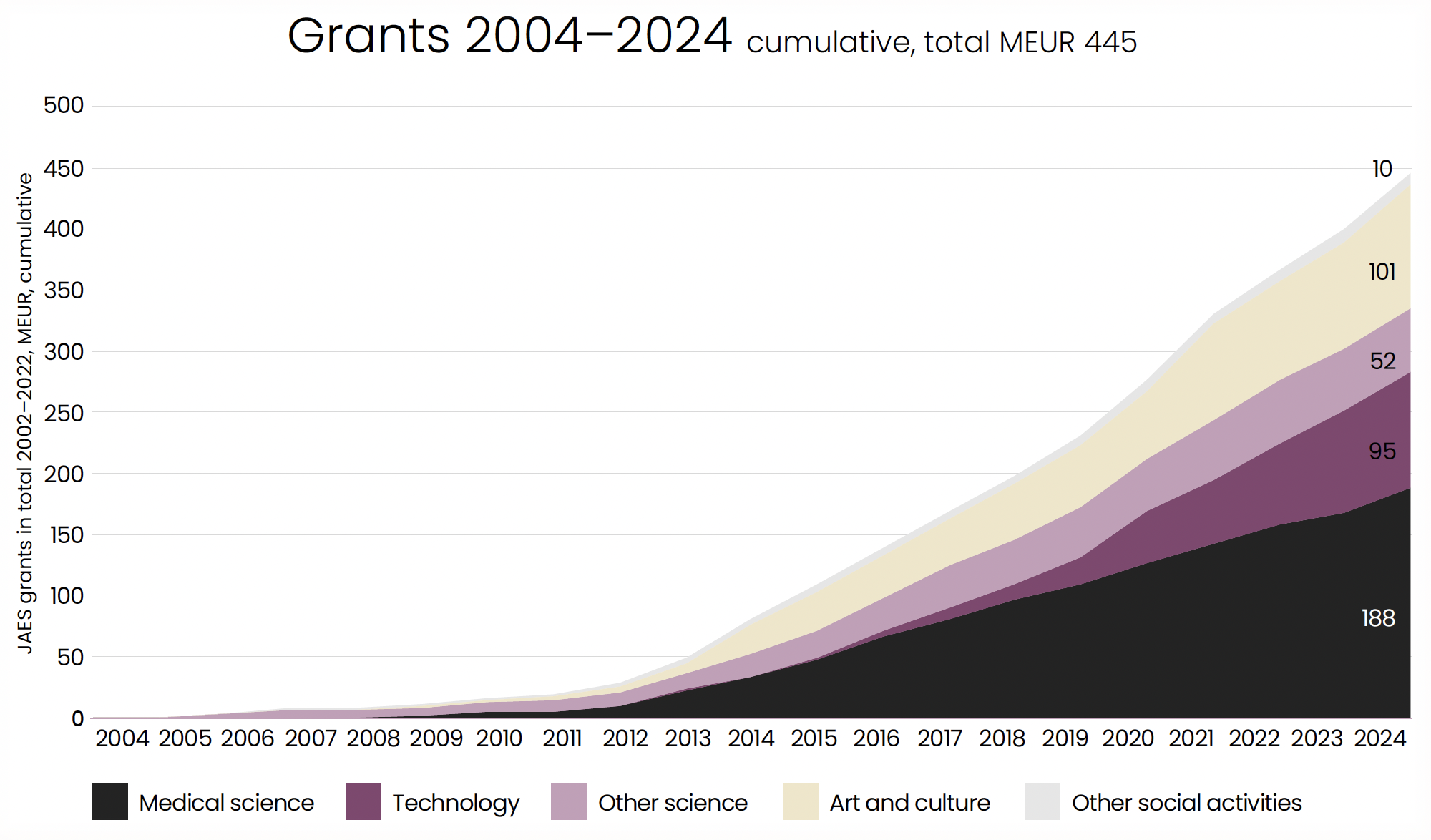

The Foundation’s assets have accumulated gradually following the infusion of the initial capital by the founders in 2002 and substantial testamentary bequests received in 2012 and 2014, as well as an increase in the value of assets.

At the end of the year, the market capitalisation of the Foundation’s assets stood at EUR 1,351 million (2023: EUR 1,232m).

The assets consisted of: Directly held securities portfolio of EUR 298 million (EUR 266m); shares held in Sanoma Plc valued at EUR 305 million (EUR 277m); housing company shares valued at EUR 1 million (EUR 1m); Asipex Group’s securities portfolio of EUR 747 million (EUR 689m).

The Foundation’s wholly owned company Oy Asipex Ab is domiciled in Helsinki and it has a wholly owned Swiss subsidiary Asipex AG. By the end of the year, the Foundation had approved but not yet disbursed grants in the amount of EUR 103.3 million (EUR 91.5m).

As the investment horizon is long, the investment strategy is equity-heavy.

At the turn of the year, equities accounted for 93.5% (91.1%), fixed-income investments 6.4% (8.8%) and housing company shares 0.1% (0.1%) of the Foundation’s total assets. Of the diversified equity portfolio (excluding Sanoma shares), 86% were direct large cap equities and 14% small cap funds. Geographically, the United States accounted for 44%, Europe for 40%, Finland for 6%, Japan for 4% and other countries for 6%. The quality-oriented and liquid global equity portfolio is also well diversified by sector and company, with the largest individual investments representing approximately 3% of the equity portfolio.

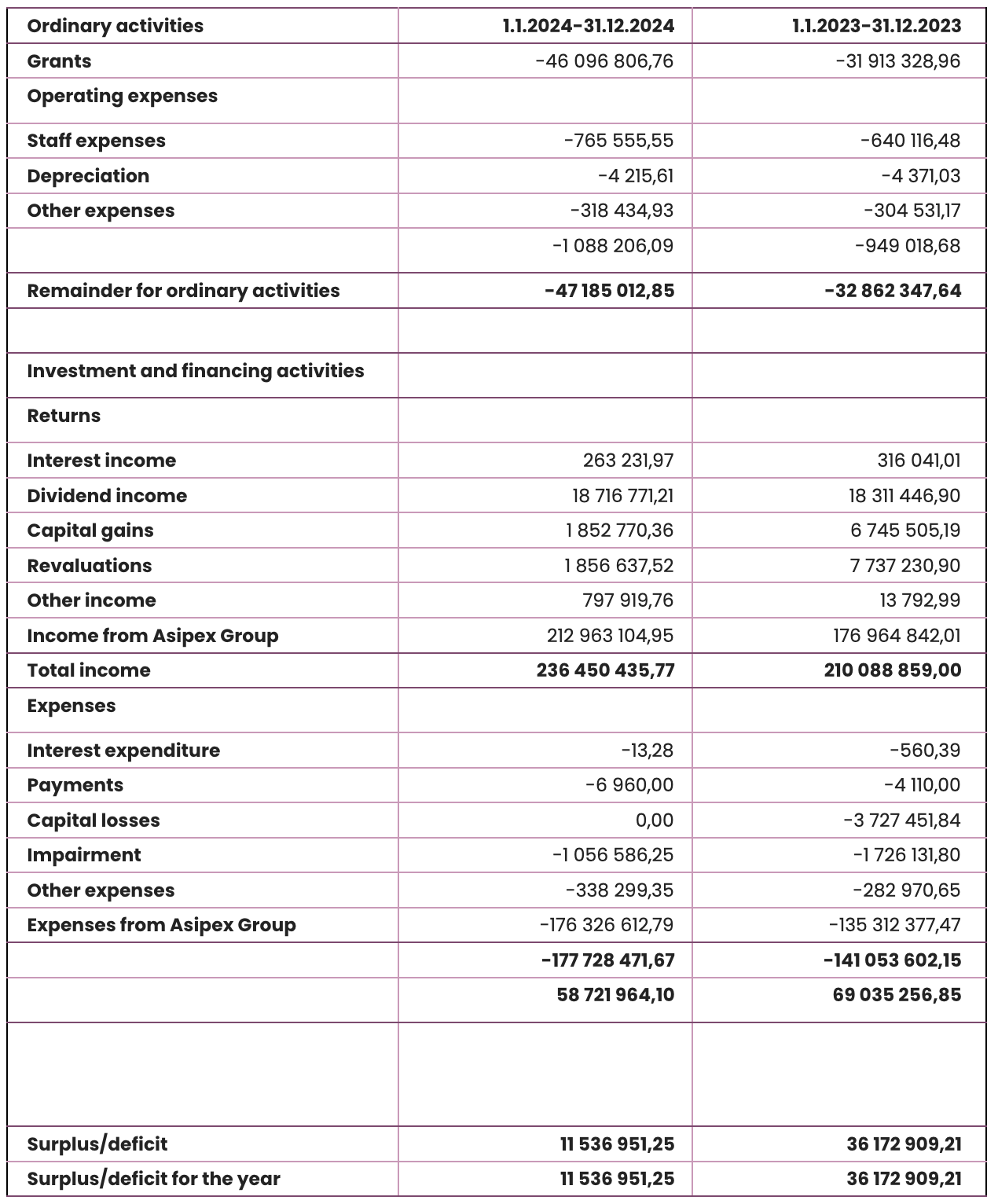

Group

The operational deficit was EUR 47.2 million (2023: EUR 32.9m). Grants awarded during the fiscal year amounted to EUR 46.3 million (EUR 32.0m). Grants recorded for 2024 were EUR 46.1 million (EUR 31.9m). The difference between awarded and recorded grants is due to the return of unused grants and cancellations. Other operating expenses were EUR 1.1 million (EUR 0.9m).

The accounting return on investments owned by the Foundation was EUR 58.7 million (EUR 69.0m). Of this, the subsidiary group’s net income was EUR 36.6 million (EUR 41.7m), dividend income from shares EUR 17.6 million (EUR 17.4m), revaluations of shares and fund units EUR 0.8 million (revaluations EUR 6.0m), sales proceeds on investments EUR 1.9 million (EUR 3.0m), fund profit participations EUR 1.2 million (EUR 0.9m), interest income and expenses EUR 0.3 million (EUR 0.3m) and other financial income and expenses EUR 0.5 million (EUR -0.3m).

The surplus for the 2024 financial year was EUR 11.5 million (surplus EUR 36.2m).

Parent foundation

The surplus of the parent foundation for the financial year 2024 was EUR 6.9 million (2023: deficit EUR 5.5m).

2024 was a good investment year as a whole, but returns were very unevenly distributed between different markets and sectors. Key themes included a decline in inflation, which allowed central banks to ease monetary policy from the summer onwards, and the US elections and potential impacts on trade policy and tariffs towards the end of the year.

The United States surprised with faster-than-expected economic growth (GDP estimated at +2.7%) and also with earnings growth of approximately +10% for companies. Difficult development of the real estate market and weak consumer confidence continued in China.

China has also changed from being an important export destination into a major competitor in certain industries, especially from Europe’s point of view. Geopolitical crises (Ukraine, Middle East), political uncertainty in Europe (government crises in France and Germany) and weak industrial demand led to soft economic growth in Europe (GDP estimated at +0.8%) and earnings growth of only +2%.

In the global equity market, the United States and the technology sector were clear winners driven by the AI theme, while Europe and emerging markets lagged behind.

For the second consecutive year, the US yielded well over +20% (most recently in 1998–1999) and one-half of the return was generated by Magnificent 7 technology stocks. In addition, the strengthening of the dollar by +7% further boosted US returns. The Finnish equity market deviated from the global development and remained at zero return.

Equity index returns 2024 (EUR): the MSCI World AC Index returned +25% (+18%), the SP500 Index +33% (+22%), the SP500 Equal weight Index +21% (+10%), the Nikkei Index +16% (+18%), the MSCI Europe Index +9% (+16%), the MSCI Emerging Market Index +10% (+6%), the OMX Helsinki Cap Index 0% (-1%).

- The return on the Foundation Group’s investments in 2024, considering unrealised changes in market values, was +13.0% (+1.3%).

The diversified equity portfolio (excluding Sanoma shares) returned +13.4% (+16.3%), slightly falling short of the market return with the corresponding geographical allocation. As in the market as a whole, the exceptionally strong development of technology and communications service companies was a significant return driver in the equity portfolio.

The return on Sanoma shares was +16.5% (-26.7%). At the end of the reporting period, the ten-year total return on the Foundation’s diversified equity investments was excellent, approximately 9% p.a. The Foundation’s annual returns can vary significantly due to the high weight of stocks in the portfolio.

The Foundation holds 39,820,286 shares in Sanoma Plc, representing 24.35% of the aggregate of shares and voting rights in the company.

The total return on Sanoma Plc shares inclusive of unrealised changes in value was +16.5% (2023: -26.7%). The dividend yield from Sanoma Plc to the Foundation in 2024 was EUR 14.7 million (EUR 14.7m).

The foundation invests its funds responsibly, considering environmental, social responsibility, and good governance factors in all asset classes, in addition to economic aspects when making investment decisions.

The definitions, regulations, reporting, and measurement methods related to responsibility are still evolving throughout society. Therefore, the Foundation believes that responsibility should be examined comprehensively and from multiple perspectives.

The Foundation’s Board approves the principles of responsible investing annually as part of the investment policy.

The Foundation avoids investing in companies whose business activities are significantly related to alcohol, tobacco, recreational cannabis products or gambling. At its December meeting, the Foundation’s Board decided to update the sustainability principles with regard to the defence industry. Going forward, the Foundation may invest in companies that manufacture weapons if they are headquartered in a NATO member state and do not manufacture controversial weapons (such as nuclear weapons, cluster bombs, anti-personnel mines and chemical and biological weapons).

The Foundation regularly monitors the development of the portfolio’s responsibility and has conducted a broad responsibility analysis of the portfolio for several consecutive years in collaboration with a partner. The analysis conducted in 2024 covered almost 96% of the Foundation’s total assets and practically the entire equity portfolio. According to the analysis, the foundation’s portfolio was at least on par with the benchmark index (MSCI World) in terms of all operational metrics.

The analysis indicated that the Foundation’s portfolio had more positive thematic exposures and fewer negative or ambiguous themes compared to the benchmark index. Positive themes particularly highlighted compared to the benchmark index included the pharmaceutical and health technology sectors and, due to the Sanoma holding, the education and publishing sectors.

The Foundation also invests in some companies with negative thematic exposures that are, however, leading their sectors in transitioning towards a low-carbon society. Such companies must have an ambitious, scientifically validated, and Paris Agreement-aligned emission reduction target. In spite of these investments, the Foundation’s carbon footprint was 26% lower than the benchmark index.

Risk management

The Foundation operates on the strength of its investment assets, and its core activities are well established. In risk management, the foundation emphasises good and transparent governance and clear internal processes. The most significant risks are related to the management of investment assets and market risk, the price and anchor ownership risk of Sanoma Plc shares, and potential reputational risks in grant activities.

Regular evaluation and, if necessary, updating of core processes, operational methods and job descriptions address the needs of a changing society and reduce the vulnerabilities of a small organisation.

The primary goal of the Foundation’s investment activities is to maintain and increase the real value of assets over the long term. Other investment goals include stable cash flow and sufficient liquidity to ensure the continuity of core activities. With a long investment horizon, the investment strategy is equity-heavy (the equity weight was 93.5% at the end of the year), and the investment portfolio is generally not hedged.

Short-term price fluctuations are not significant for the foundation, as it aims for good real returns and cash flow over the long term. Annual returns typically vary significantly.

In line with the investment strategy, investments are diversified geographically, by industry, by company and by currency. Investments are primarily in liquid securities and funds, which can be quickly converted into cash, resulting in very low financial and liquidity risk for the Foundation. ESG factors are considered as part of investment activities and risk management. A broad responsibility analysis of the investment portfolio is conducted annually with a partner.

The domestic and international economic situation affects the foundation’s investments. The risks of investment activities are mainly related to general market risk, i.e., the long-term development of international stock markets and dividend income.

Additionally, about 23% of the Foundation’s assets consist of Sanoma Plc shares, which represent the largest single price risk.

The management of cash assets and investment activities is carried out in accordance with the investment policy approved by the Board, and matters related to investment activities are handled by the Foundation’s Financial Committee.

The investment activities and risk management of the Asipex Group follow the investment policy approved by the company’s Board, which is in line with the investment policy of the Jane and Aatos Erkko Foundation described above.

Communications

The purpose of the Foundation’s communications is to provide information about the Foundation’s objectives and the processes and tools related to grant activities, thereby facilitating the work of both applicants and those carrying out projects. The operating principles that guide communication are interaction and flexibility, as well as an active approach to the development of work.

Advice and customer service as well as stakeholder-specific meetings and presentations are an important part of the Foundation’s communications. Quarterly newsletters open up topical themes of grant activities and make the work of the recipients of assistance visible with more extensive articles.

During the year, information and discussion events were organised in cooperation with various umbrella organisations in the arts sector. During the year, the Foundation also participated in a university meeting coordinated by the Association of Finnish Foundations in Lappeenranta, as well as events organised by different project operators across Finland. The information gained during the events helps to identify the developments in science and arts more broadly, increases the understanding of the daily life of operators and clarifies the image of the impact of grant activities.

Data protection and document management

When submitting applications for funding or reports to the Jane and Aatos Erkko Foundation, the applicants and grantees disclose personal information on themselves and potentially other members of their team, which creates a personal data file to be managed by the Foundation. The Foundation has used its best efforts to put in place a transparent procedure in which the rights of the applicants and grantees are duly taken into account as required under the legislation and regulations on data protection.

Administration

The Annual General Meeting held on 22 March 2024 appointed Nils Ittonen Chair of the Board and Juhani Mäkinen Deputy Chair.

Marianne Heikkilä, Reetta Meriläinen, Mikko Mursula, Jussi Pesonen, Sari Pohjonen, Kerstin Rinne and Antti Vasara were appointed members of the Board. Outi Vaarala and Anna Valtonen were appointed deputy members. The deputy members also attended Board meetings during the year.

The term of every Board member ends at the following General Annual Meeting. No member or deputy member can be elected to the Board of Directors if they have reached the age of 75 or reach it during their term of office.

The Board convened five times during the reporting period. Foundation matters are also processed outside meetings.

At the General Annual Meeting, the Board appointed Mikko Mursula Chair of the Financial Committee with Nils Ittonen, Hanna-Mari Peltomäki and Karl Tujulin appointed members.

The Financial Committee monitors the financial market and general economic developments, acting within the framework of the investment strategy adopted by the Board. The Financial Committee convened four times during the reporting period.

At the General Annual Meeting, the Board appointed Nils Ittonen Chair of the Working Committee, while Juhani Mäkinen and Hanna-Mari Peltomäki were appointed members.

The Working Committee prepares matters for presentation to the Board. The Working Committee convened four times during the reporting period.

At the General Annual Meeting, the Board appointed Antti Vasara Chair of the Expert Committee, while Nils Ittonen and Hanna-Mari Peltomäki were appointed members.

Experts are convened when necessary to deal with the matters to be addressed. The matters presented to the Expert Committee are prepared by teams of specialists appointed for the specific fields. The names of the experts are not disclosed.

A key success factor of the Foundation is a high-quality evaluation process based on peer review. The reviewers are experts from various fields, and they also contribute to other developmental work that promotes the foundation’s grant activities. The Foundation appoints experts for each strategic period. The names of the experts are not disclosed. Any disqualifying factors are taken into account in the review.

The Jane and Aatos Erkko Foundation is a member of the Association of Finnish Foundations. The purpose of the Association is to look after the common interests of Finnish grant foundations, funds and societies as well as to promote and develop corporate governance practices and professional skills.

Secretary General Hanna-Mari Peltomäki is currently serving on the Board of the Association of Finnish Foundation (2023–2025).

During the reporting period, the Foundation employed an average of eight people of whom four worked for the subsidiary group. During the year, the new role of Head of Stakeholder Relations was established to strengthen more goal-oriented stakeholder cooperation.

The key success drivers in the Foundation’s operations are a qualified and motivated staff, a committed Board and an extensive high-quality network of partners.

Secretary-General Hanna-Mari Peltomäki participated in the 248th National Defence Course on 4–27 March 2024.

Related party transactions

During the fiscal year, the Foundation’s Board fees were EUR 245,600, and the Secretary General’s taxable salary was EUR 130,288.

Board members have received monthly fees and meeting fees for Board and committee work.

The monthly fee for the Chair of the Board was EUR 2,000, and for members, EUR 1,500. Meeting fees for the Chairs of the Board and committees were EUR 600, and for members, EUR 500. Board members also work outside of meetings.

The Foundation has had no other remunerated or non-remunerated transactions with related parties besides the auditors’ fees. Moreover, the Foundation has not provided loans or guarantees to related parties.

Sustainability

A report on the foundation’s sustainability was prepared during the year. The report reviewed the theme extensively in terms of the Foundation’s three most important areas of activity: grant activities, investment activities and good governance. Climate and environmental responsibility were discussed in detail in each area. A review of the current situation and different processes from the perspective of sustainability clarified the existing practices. The Board raised separate themes from the report for further preparation.

Financial auditing

At its Annual General Meeting of 22 March 2024, the Foundation Board appointed PricewaterhouseCoopers Oy as the auditor of the Foundation’s accounts, with Tiina Puukkoniemi, APA, serving as the auditor-in-charge

Activities in the current year

The Foundation’s grant policy is defined by the strategy (2024–26), the implementation of which is assessed by, for example, actively monitoring the operating environment. The strategy meeting for the year examines the Foundation’s role and objectives in economic research, arts and culture in more detail.

As a follow-up to the extensive sustainability review work, the preparation of the Foundation’s risk management plan will be initiated and the principles for calculating the long-term average return expectation and annual distribution fund will be defined.

The development of the Foundation’s own information management systems will continue in the monitoring of the operating environment and the accumulation of information.

During the year, a stakeholder analysis will also be carried out to support communications, on the basis of which a more target group-specific action plan will be prepared. A more targeted operating model will increase the Foundation’s impact.

A Nordic foundation conference will be organised in Helsinki in September 2025, and Finland will be responsible for coordinating it. The Foundation is actively involved in organising the event.

Income statement

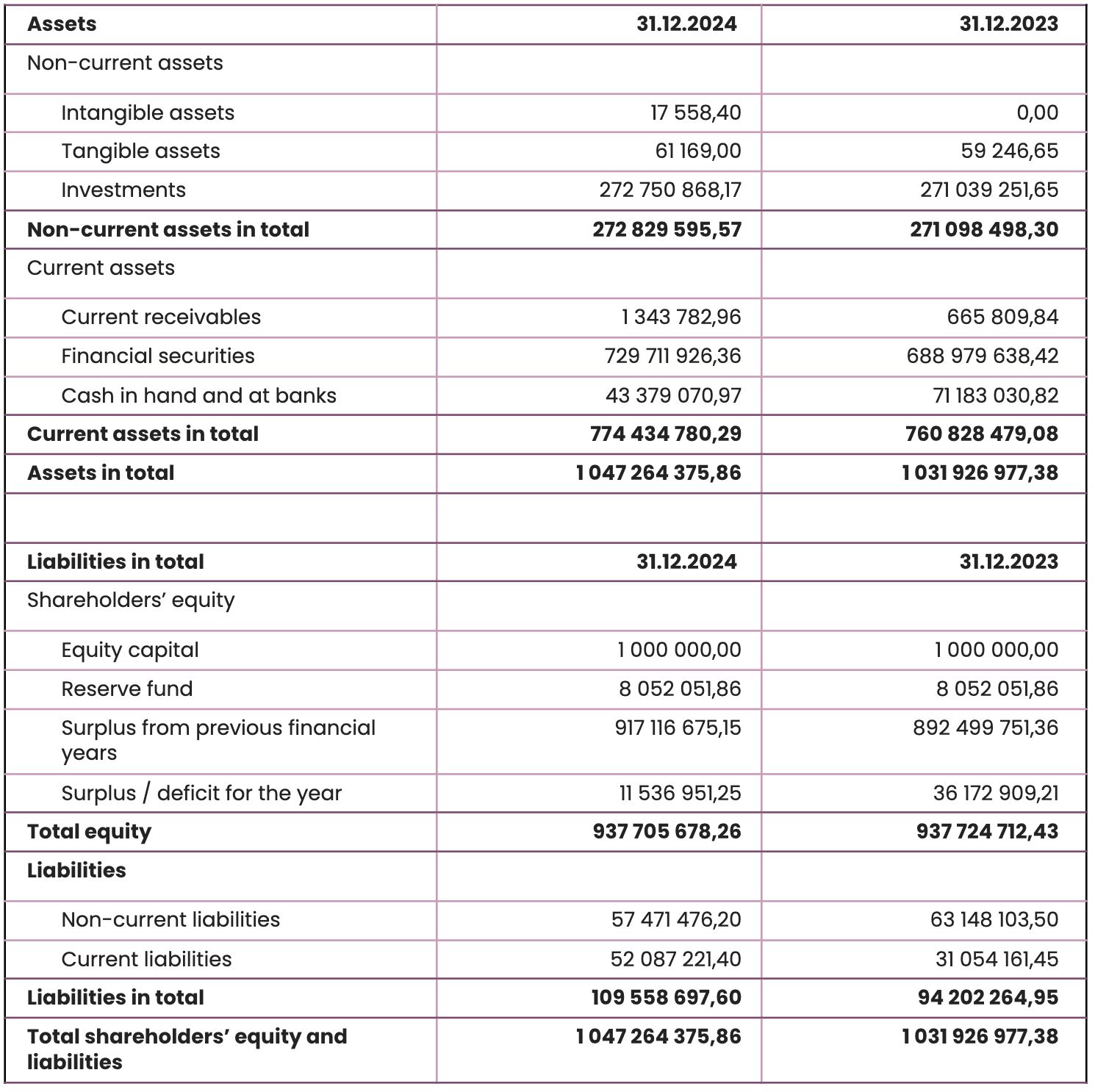

Balance sheet