Vuosi

2023

Annual Report and Profit Statement

The Jane and Aatos Erkko Foundation’s primary goal is to promote and support research and teaching in the fields of technology, economics and medicine. Another goal is to promote arts and culture as well as sports and physical education and wellbeing in the interests of the Finnish nation.

Foundation

The Foundation fulfils its mission by supporting research of international standard aiming at scientific breakthroughs. The grant activities focus primarily on medicine and technology. The number of grants to economic research has been low since the amount of applications that fulfil the grant criteria has been low.

The Foundation also aims to promote international level arts and culture, and to support projects that promote the potential and competence of organizations and entire sectors. Due consideration is given to the areas of interest expressed by the founders within the limits imposed by the Foundation Charter.

The Foundation does not single out any specific priorities or themes for its grant activities in the field of art or science. The Proof of Concept funding is used to support novel ideas with significant potential and unusually high level of risk. Proof of Concept funding may spawn more extensive projects with broader benefits, or open new avenues of research.

The Foundation awards grants primarily to teams, groups and organisations. Eligible projects may also involve several fields of science or consist of consortia formed by several organizations. The Foundation does not award personal grants for doctoral or post-doctoral projects. However, research within broader projects is usually carried out by early-stage researchers. Hence, the educational impact of the Foundation grants is significant in that they provide employment for doctoral and post-doc researchers. One of the Foundation’s goals is also to facilitate the career advancement of young researchers.

Grants are awarded for projects whose significance and impact can be directly assessed by the Foundation Board. In preparing the grant proposals, the Foundation relies on external experts who are also involved in other development efforts designed to contribute to the Foundation’s grant activities. The primary goal of the Foundation’s investment activities is to preserve and increase the real value of its assets in the long term. Other objectives include a steady cash flow and adequate liquidity needed to ensure the continuity of grant activities. All grant decisions are made with due regard to the Foundation’s financial position. Grants are disbursed three times a year (January, May and September).

The Foundation operates responsibly and sustainably in all areas of its activities.

Activities carried out during the reporting period to accomplish the foundation’s mission

In 2023, the Foundation awarded a total of EUR 32 million (EUR 36.6 million in 2022) in grants for science, arts and culture.

EUR 26.6 million (EUR 33.6m) was allocated to scientific research, which accounted for 83.2% (91.9%) of the total, while medicine, inclusive of medical technology, received EUR 10.1 million (EUR 16.8m).

Technology grants amounted to EUR 16.6 million (EUR 13.4m). EUR 5.4 million (EUR 33.6m) was allocated to arts and culture projects, which accounted for 16.8% (8.1%) of the total of grants awarded in 2023.

The approval rate of all grant applications was 11.3% (13%). In terms of euros, the approval rate was 17% (28.2%). Extensive, cutting-edge projects reflecting the Foundation’s core objectives (long-term, high impact projects of EUR 1 million or more) accounted for 14% (25%) of the year’s grants.

The Foundation has no specific application periods and applications are processed throughout the year. The number of applications received during the year (506) increased by 27% relative to the previous year (400). The Foundation continued the processing of science applications with the rotation of reviewing the medical projects for the March and September and technology projects for the May and December board meetings. Applications related to other scientific disciplines and culture projects continued to be reviewed at all four board meetings.

The return on investments in 2023, with due regard to unrealised changes in market values, was +1.3% (-20.7%). The Sanoma Plc shares returned -26.7% and other investment assets +14.2%.

At the turn of the year, the market value of the Foundation’s assets totalled EUR 1,232 million (EUR 1,256m). Of this, equities accounted for 91.1% (89.3%) and fixed-income instruments 8.8% (10.6%).

The surplus for the 2023 financial year was EUR 36.2 million (2022 deficit EUR 51.2m).

The year 2023 also marked the end of the Foundation’s 2021–23 strategy period. One of its key objectives was to expand the scope of the technology grant activities along with the more established grants for research in medicine. During the strategy period, grants for technology research increased by 23 per cent (EUR 9 million) relative to the previous three-year period 2019–20. Over the past three years, the Foundation has developed its competences in e.g. understanding better its operating environment, data management, use of external experts, communications and the various IT systems that support its activities. Key indicators and highlights of the previous strategy period are provided in the attachment.

The Foundation’s grant activities

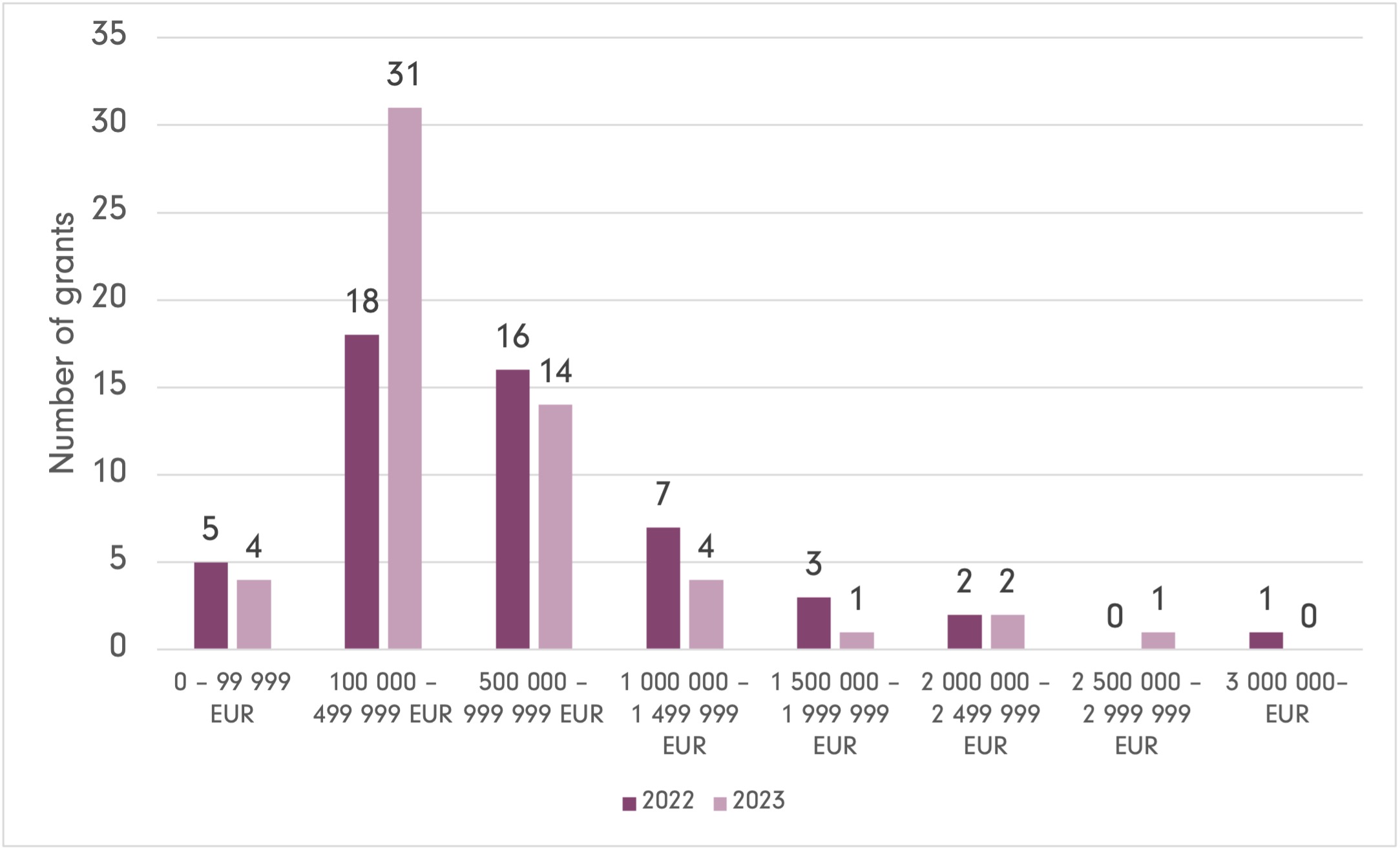

During the year under review, grants totalling EUR 32 million (EUR 36.6m) were awarded to 57 (52) research teams, organisations and consortia. Of the approved applications, 42 (39) were for scientific research and 15 (13) for cultural projects. A total of 8 (13) grants in excess of EUR 1 million were awarded for extensive multi-year projects and 14 (16) grants for projects with budgets ranging from EUR 500,000 to EUR 1,000,000.

Breakdown of grants by size (EUR) in 2022 and 2023

The 2023 grant activities are characterised by the Foundation’s policy to support long-term projects, as well as to enable new ventures and support risk-taking. Among the grantees were both experienced scientists as well as researchers who were still in the process of setting up a team. Common to all the projects are societal relevance and potential for a broader significance.

Grant projects were selected in accordance with the Foundation’s mission as defined in the by-laws and the current strategy. When applications are processed, due consideration is given to the regulations on disqualification, and the impact of potential conflicts of interest on preparation and decision-making.

Further efforts to develop the grant activities will draw upon the findings made in project evaluations and monitoring as well as more extensive sectoral reviews. The accumulated information will help identify current trends in science and the arts more broadly, contribute to an understanding of the day-to-day work of the applicants as well as give a better idea of the impact of the grant activities.

Promotion of science

Science accounted for a significant percentage of the grants (83.2%) awarded in 2023. Grants were allocated to medicine and technology, including other scientific disciplines that support and facilitate the Foundation’s main disciplines.

In medicine and technology, the number of applications increased relative to 2022, both in terms of numbers and in euros. Key assessment criteria included the promotion of ‘high risk–high gain’ research, the broader relevance of the project as well as the quality and feasibility of the project plan.

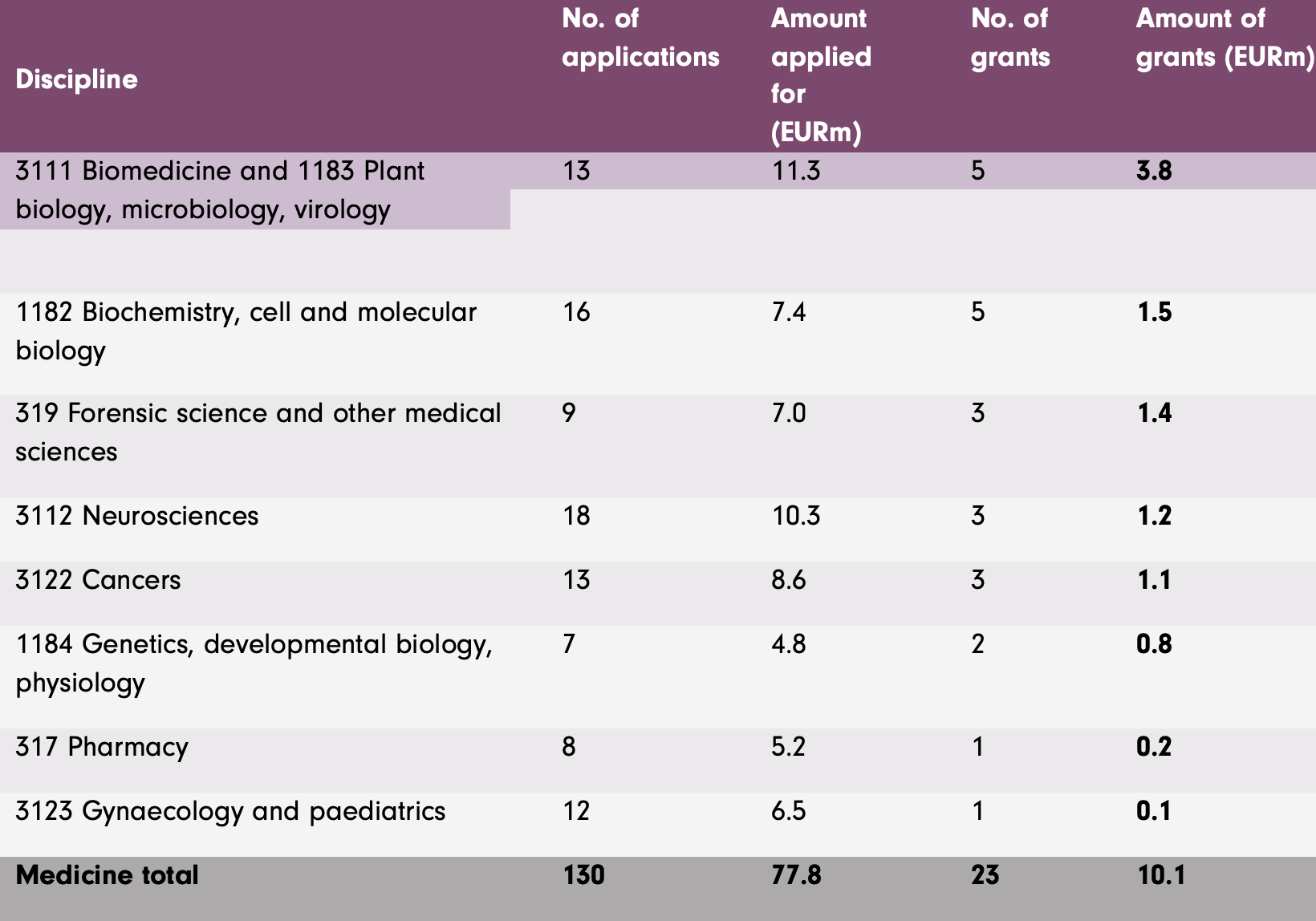

Medicine

Grants awarded for medicine, inclusive of medical technology, accounted for 40% of the total number of grants, or 31% in terms of amount in euros.

Applications and awards by scientific discipline in 2023

There was a strong focus for basic and translational research both in applications and grant awards.

Medical applications and grants (EURm) by type of research in 2023

Regionally, topping the list of grantees are the University of Helsinki, University of Turku and Tampere University. About 45% of the applications and awards were related to projects worth more than EUR 500,000. High-risk Proof of Concept applications accounted for 10% of the applications and around 13% of the grants.

The biggest single grant of the year (EUR 1,000,000) was awarded to Professor Matleena Parikka of the Tampere University. This four-year follow-up grant is a prime example of the Foundation’s policy for providing long-term funding for successful research. The infection biology team headed by Parikka is looking for more effective treatments for tuberculosis. Tuberculosis remains one of the most common and deadly infectious diseases in the world, and the number of cases is also increasing in Finland. Moreover, the development of new effective treatment strategies that reduce treatment times will also support the fight against antibiotic resistance.

Aside from internationally relevant research, the Foundation also highlighted themes of national importance.

On 6 December 2023, the Foundation, together with the Finnish Medical Foundation and the Sigrid Jusélius Foundation, launched a ‘Brain Import’ programme designed to encourage top medical researchers of international stature to return to Finland. The call for applications announced in December offers one EUR 2.5 million grant for five years which will cover the researcher’s personal salary as well as part of the payroll costs of the team. The programme, now implemented for the first time, serves as a pilot scheme and provides information on the need for funding and any impediments to harnessing or execution. The programme and related assessment are carried out during spring 2024. Potential continuation will be subject to a specific decision.

The Foundation also took part in a data experiment for medical foundations launched by the Finnish Academy of Science and Letters and designed to identify future trends in medicine and provide information on the allocation of foundation funding. Other areas of interest in the data experiment included new methodology and testing to determine the potential and limitations of artificial intelligence. The results of the experiment are presented to the Foundation in spring 2024.

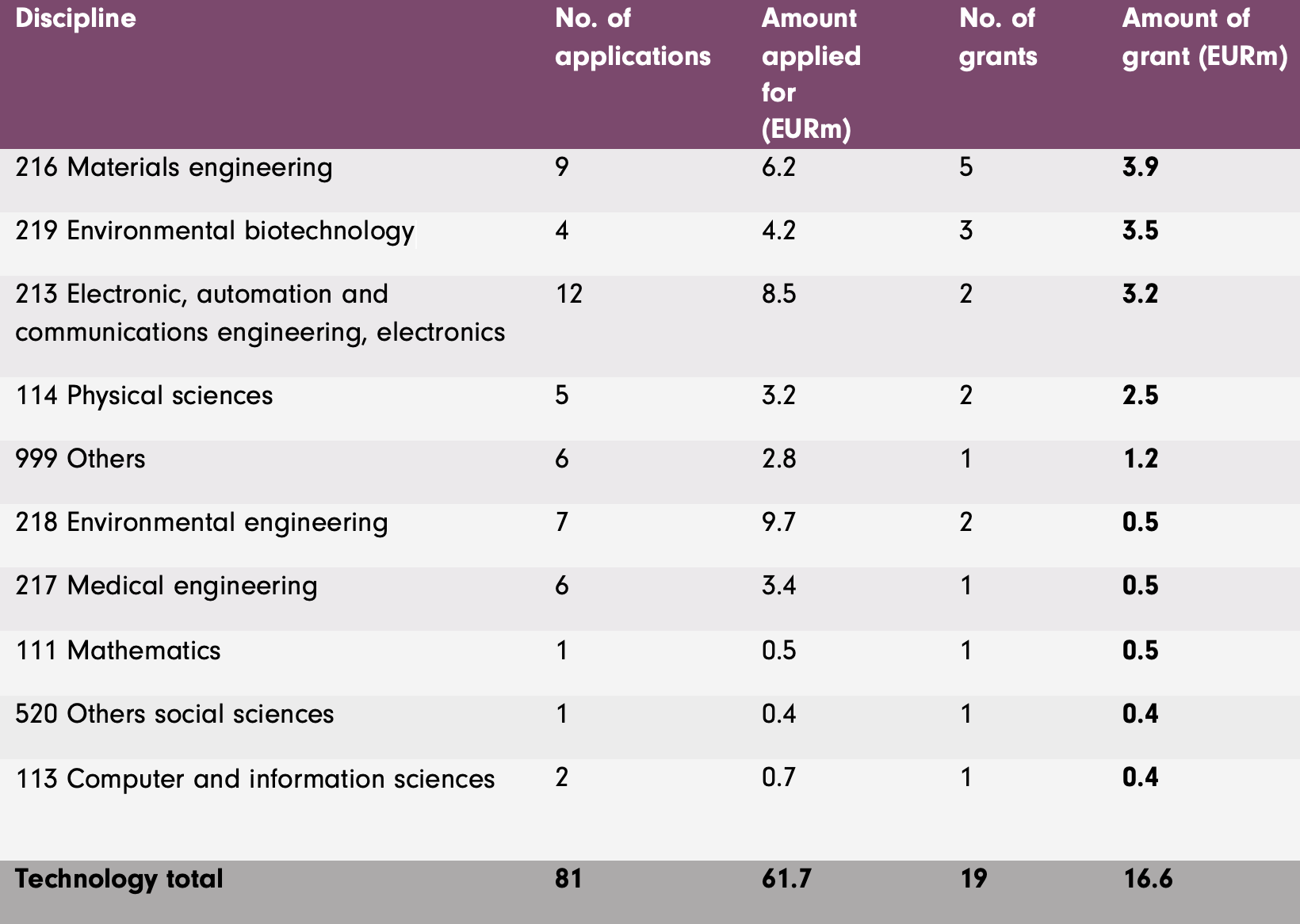

Technology

Of the applications granted, some 33% were related to technology, representing 52% of total funding.

Applications and awards by scientific discipline in 2023

A total of 49% of the applications and 53% of the grants were related to projects worth more than EUR 500,000. Proof of Concept applications accounted for around 10% of all applications, and around 8% of the awarded grants. Geographically, most of the grants went to Aalto University as well as University of Jyväskylä, University of Turku and University of Eastern Finland.

The largest single grant for technology research (EUR 2,998,000) was awarded to the Digital Citizen Science Centre, a joint project of the four faculties of the University of Jyväskylä and the University of Helsinki’s Natural History Museum ‘Luomus’.

The mission of this multi-disciplinary centre is to harness a new digital research method and tool for top level research. The app will be used in cross-disciplinary projects, while allowing citizens to participate in the generation of knowledge. The funding provided for the Digital Citizen Science Centre will support open science and civil engagement of social relevance for the promotion of science.

Professor Päivi Törmä of Aalto University is heading a project that is a prime example of international collaboration, bringing together top European and US researchers on the theme of superconductivity. This ambitious project seeks to achieve room temperature superconductivity in ten years. A total of EUR 2,000,000 was awarded to this project for a period of four years. While the complex quantum phenomenon underlying superconductivity is not yet fully understood, the project, if successful, would make it possible, inter alia, to build equipment that are several orders of magnitude more energy efficient than today, which could greatly contribute to e.g. solutions to the climate crisis.

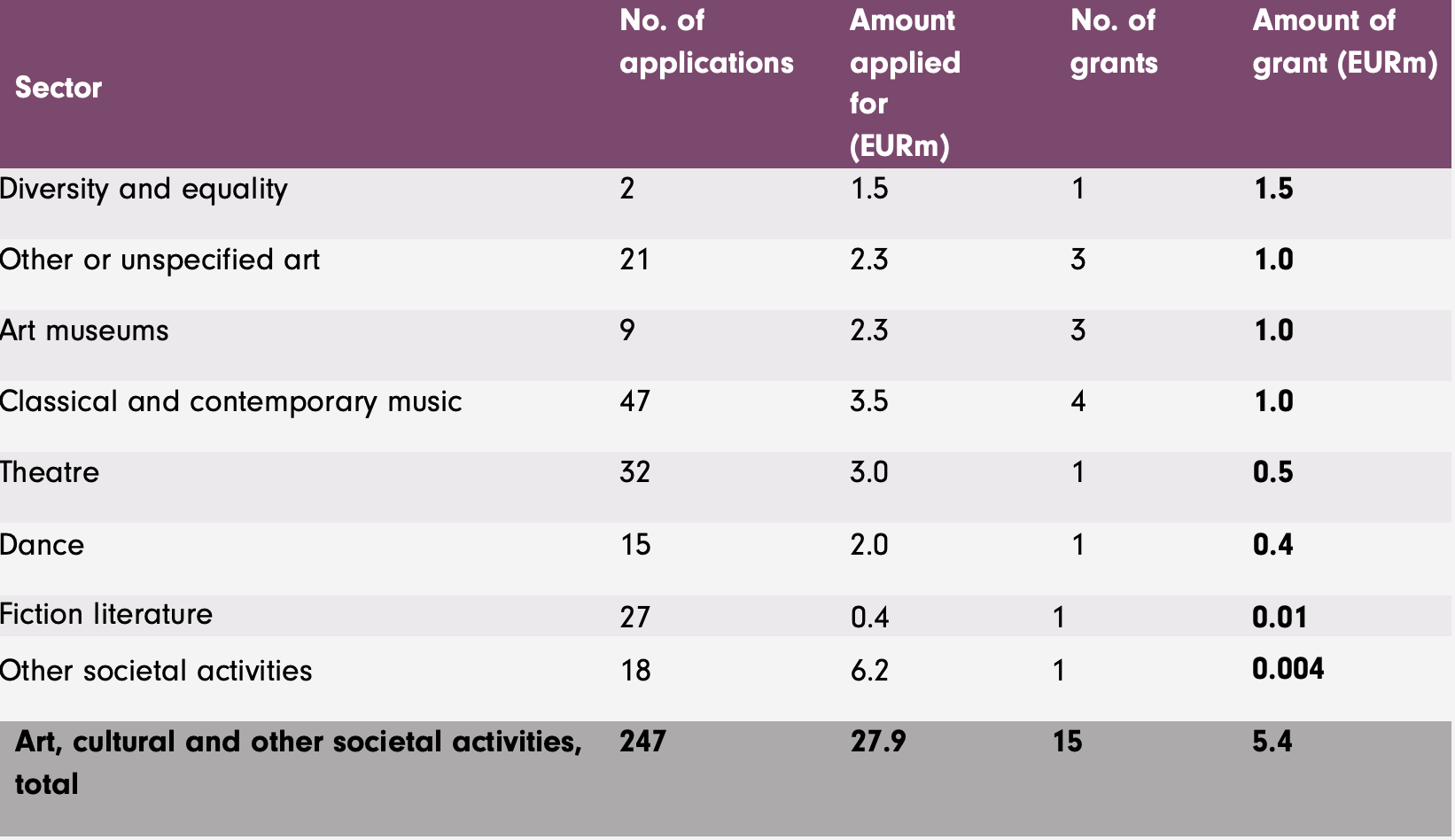

Art, culture and other grant activities

Some 26% (25%) of the grants in 2023 were awarded to art and culture, representing about 17% (8%) of total funding. The grants enabled e.g. guest performances at various venues in Finland and abroad while contributing to new ways of working and forms of content that will help the grantee organisations to renew their own activities. The cross-cutting themes were internationalisation, skills development and inclusion. Key criteria in the evaluation included the skills and competence of the applicants as well as the feasibility and relevance of the projects to the sector involved.

Art and culture related applications accounted for about half of the total in terms of number of applications, but only about 17% in terms of total amount of euros.

Applications and awards by sector in 2023

The biggest single grant of the year – EUR 1,500,000 – was awarded to the Culture Kids programme launched by the City of Helsinki. The programme, which brings together a wide range of actors, offers artistic, sporting and cultural experiences for all children aged 0-7 born in 2020 or later and living in Helsinki, including their families. A three-year follow-up grant will allow the programme to achieve maturity: as a concept, it is unique even by international standards and applicable to a wide range of activities.

Overview of the projects completed in the reporting period

Finished projects are reported to the Foundation within six months of completion. The reports are also important in that they help the Foundation keep up with the developments in its operating environment. The new reporting procedures adopted in 2022 were designed to allow those carrying out the project to express a more comprehensible and personal opinion of the success of the project. All the final reports received in 2023 were submitted using the new reporting template. Aside from financial data, the reports provide a more concrete description of the outcomes, future prospects, potential impediments to execution or changes as well as career prospects. The efforts to diversify the ways in which the reports are utilised will be continued in 2024.

A total of 50 projects were brought to completion during the reporting period. In terms of volumes, the largest number of projects (21 projects with total worth of EUR 5,443,252) were completed in the field of culture, followed by medicine and medical technology (18 projects with the total worth of EUR 10,676,000). Of the technology projects, final reports were received on 10 projects (EUR 6,384,00), four of which were part of the Future Makers Programme. One project in other sciences (EUR 993,000) was completed.

The completed projects were scheduled to take place in years 2015–23, primarily 2018–23. At the time when the grants were awarded, the science projects were estimated to take an average of 34 months, while the actual duration was 46 months. The main reason for the extended duration was the Covid-19 pandemic.

Projects that made good progress, achieved their objectives or introduced new research approaches were successful in attracting follow-up funding, either from the Foundation or elsewhere. The Foundation’s policy is that a research project or other activity is eligible to apply for additional funding if the initial objectives are met. Nine projects completed during the reporting period were awarded follow up funding from the Foundation.

One of the projects brought to completion in 2023 was the New Organ for the Helsinki Music Centre. In 2017, the Foundation awarded a EUR 500,000 grant for the project to build a modern, high-quality concert organ for the Centre. The new organ had its concert premier on 1 January 2024. As part of the anniversary year, another EUR 100,000 grant was awarded to a society committed to maintaining the organ.

The instrument will offer new opportunities for the Finnish music scene.

Finances of the foundation

The Foundation’s assets have accumulated gradually following the infusion of the initial capital by the founders in 2002 and substantial testamentary bequests received in 2012 and 2014.

At the end of 2023, the market capitalisation of the Foundation’s assets stood at EUR 1,232 million (EUR 1,256m) consisting of a directly held securities portfolio of EUR 266 million (EUR 234m); shares held in Sanoma Plc valued at EUR 277 million (EUR 391m); housing company shares valued at EUR 1 million (EUR 1m); and Asipex Group’s securities portfolio of EUR 689 million (EUR 630m). The Foundation’s wholly owned company Oy Asipex Ab is based in Helsinki and it has a wholly owned Swiss subsidiary Asipex AG. By the end of 2023, the Foundation had approved but not yet disbursed grants in the amount of EUR 91.5 million (95.9m).

At the turn of the year, equities accounted for 91.1% (89.3%), fixed-income investments 8.8% (10.6%) and housing company shares 0.1% (0.1%) of the Foundation’s total assets.

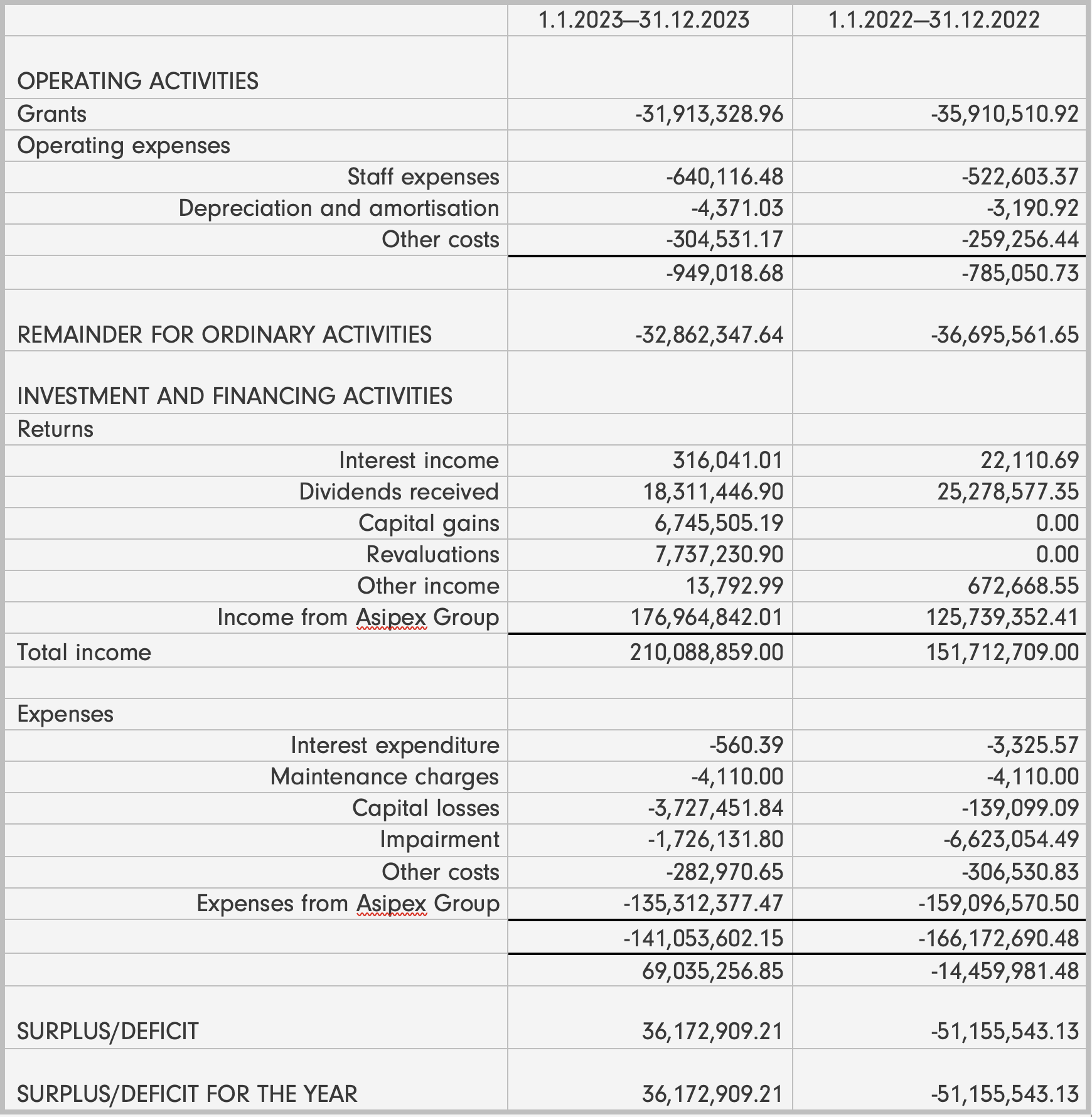

Group

The operational deficit was EUR 32.9 million (2022: EUR 36.7m). Grants awarded during the fiscal year amounted to EUR 32.0 million (2022: EUR 36.6m). Grants recorded for 2023 were EUR 31.9 million (2022: EUR 35.9m). The difference between awarded and recorded grants is due to the return of unused grants and cancellations. Other operating expenses were EUR 0.9 million (2022: EUR 0.8m).

Säätiön omistamien sijoitusten kirjanpidollinen tuotto oli 69,0 miljoonaa euroa (-14,5 miljoonaa euroa). Tästä tytäryhtiökonsernin nettotuotto oli 41,7 miljoonaa euroa (-33,4 miljoonaa euroa), osakkeiden osinkotuotot 17,4 miljoonaa euroa (24,5 miljoonaa euroa), osakkeiden ja rahasto-jen arvonpalautukset 6,0 miljoonaa euroa (arvonalennukset 6,6 miljoonaa euroa), sijoitusten myyntivoitot 3,0 miljoonaa euroa (-0,1 miljoonaa euroa), rahastojen voitto-osuudet 0,9 miljoonaa euroa (0,8 miljoonaa euroa), korkotuotot ja kulut 0,3 miljoonaa euroa (0,0 miljoonaa euroa) ja muut rahoitustuotot ja -kulut -0,3 miljoonaa euroa (0,4 miljoonaa euroa). Vuoden 2023 tilikauden ylijäämä oli 36,2 miljoonaa euroa (alijäämä 51,2 miljoonaa euroa).

Parent foundation

The deficit of the parent foundation in the financial year 2023 was EUR 5.5 million (2022 deficit EUR 17.8m).

During the fiscal year, the foundation’s board fees were EUR 233,200, and the Secretary General’s taxable salary was EUR 119,088.

Board members have received monthly fees and meeting fees for board and committee work. The monthly fee for the chairman of the board was EUR 2,000, and for members, EUR 1,500. Meeting fees for the chairmen of the board and committees were EUR 600, and for members, EUR 500. Board members also work outside of meetings.

The foundation has had no other remunerated or non-remunerated transactions with related parties besides the auditors’ fees. The foundation has also not provided loans or guarantees to related parties.

The returns on investment markets in 2023 were fair, given the cautious expectations, for both equities and bonds. Even though the widely anticipated recession in the United States did not materialize, the inflation rate decreased. In the spring, markets were briefly shaken by the regional banking crisis in the United States, and until autumn, uncertainty was created by central banks’ interest rate hikes. Geopolitical risk also increased throughout the year, partly due to the Gaza conflict.

However, stock markets made a very strong recovery towards the end of the year as inflation fell closer to target levels and central banks indicated that the cycle of interest rate hikes was over. The rise in stock indexes was narrowly based. Particularly, the technology sector rose strongly, supported by the AI theme, with the “Magnificent Seven” stocks (Apple, Microsoft, Nvidia, Amazon, Meta, Tesla, Alphabet) alone accounting for almost half of the world index’s equity returns. Returns in emerging markets, led by China, were weaker, as was the case in the Finnish stock market.

Measured in euros, including dividends, for example, the MSCI World AC index returned +18% (2022: -13%), the SP500 index +22% (2022: -13%), the Nikkei index +18% (2022: -14%), the MSCI Europe index +16% (2022: -8%), the MSCI Emerging Market index +6% (2022: -15%), and the OMX Helsinki Cap index -1% (2022: -13%).

The return on the Foundation Group’s investments in 2023, considering unrealized changes in market values, was +1.3% (2022: -20.7%). The diversified equity portfolio (excluding Sanoma shares) returned +16.3% (2022: -21.3%), slightly exceeding market returns at equivalent geographical allocation. The return on Sanoma shares was -26.7% (2022: -24.7%). At the end of the reporting period, the ten-year total return on the Foundation’s diversified equity investments was still excellent, approximately 9% p.a. (2022: 10% p.a.). The Foundation’s annual returns can vary significantly due to the high weight of stocks in the portfolio.

The Foundation holds 39,820,286 shares in Sanoma Plc, representing 24.35% of the aggregate of shares and voting rights in the company.

The total return on Sanoma Plc shares inclusive of unrealised changes in value was -26.7% (-24.7%). The dividend yield from Sanoma Plc to the Foundation in 2023 was EUR 14.7 million (EUR 21.5m).

The foundation invests its funds responsibly, considering environmental, social responsibility, and good governance factors in all asset classes, in addition to economic aspects when making investment decisions. The definitions, regulations, reporting, and measurement methods related to responsibility are still evolving throughout the society. Therefore, the foundation believes that responsibility should be examined comprehensively and from multiple perspectives. The foundation’s board approves the principles of responsible investing annually as part of the investment policy.

The foundation monitors the development of the portfolio’s responsibility using a wide range of ESG metrics. Impact development is assessed from the perspective of the UN Agenda 2030 Sustainable Development Goals. The foundation avoids investing in companies whose business activities are significantly related to alcohol, tobacco, weapons, or gambling.

The foundation regularly monitors the development of the portfolio’s responsibility and has conducted a broad responsibility analysis of the portfolio for several consecutive years in collaboration with a partner. The analysis conducted in 2023 covered almost 90% of the foundation’s total assets and practically the entire equity portfolio. According to the analysis, the foundation’s portfolio was at least on par with the benchmark index (MSCI World) in terms of all operational metrics.

The analysis indicated that the foundation’s portfolio had more positive thematic exposures and fewer negative or ambiguous themes compared to the benchmark index. Positive themes particularly highlighted compared to the benchmark index included the pharmaceutical and health technology sectors and, due to the Sanoma holding, the education and publishing sectors. The foundation also invests in some companies with negative thematic exposures that are leading their sectors in transitioning towards a low-carbon society. Slightly larger investments in such companies (e.g., RWE and Holcim) than last year resulted in a higher carbon footprint for the foundation’s portfolio compared to the previous year, but it was still in line with the benchmark index. The mentioned two companies accounted for about 45% of the portfolio’s carbon footprint, although their combined weight in the portfolio was only about 0.7%. According to its responsibility principles, the foundation can invest in companies with a currently high carbon footprint but with ambitious, scientifically validated, and Paris Agreement-aligned emission reduction targets.

The goals of responsible investing also include reducing risks and identifying attractive investment opportunities that offer solutions for achieving sustainable development goals. During the fiscal year, the foundation invested e.g. in companies providing solutions for the green transition.

Risk management

The foundation operates on the strength of its investment assets, and its core activities are well established. In risk management, the foundation emphasizes good and transparent governance and clear internal processes. The most significant risks are related to the management of investment assets and market risk, the price and anchor ownership risk of Sanoma Oyj shares, and potential reputational risks in grant activities.

Regular evaluation and, if necessary, updating of core processes, operational methods, and job descriptions address the needs of a changing society and reduce the vulnerabilities of a small organization.

The primary goal of the foundation’s investment activities is to maintain and increase the real value of assets over the long term. Other investment goals include stable cash flow and sufficient liquidity to ensure the continuity of core activities. With a long investment horizon, the investment strategy is equity-heavy (the equity weight was 91% at the end of the year), and the investment portfolio is generally not hedged. Short-term price fluctuations are not significant for the foundation, as it aims for good real returns and cash flow over the long term. Annual returns typically vary significantly.

In line with the investment strategy, investments are diversified geographically, by industry, by company, and by currency. Investments are primarily in liquid securities and funds, which can be quickly converted into cash, resulting in very low financial and liquidity risk for the foundation. ESG factors are considered as part of investment activities and risk management. A broad responsibility analysis of the investment portfolio is conducted annually with a partner.

The domestic and international economic situation affects the foundation’s investments. The risks of investment activities are mainly related to general market risk, i.e., the long-term development of international stock markets and dividend income.

Additionally, about 22% of the foundation’s assets consist of Sanoma Oyj shares, which represent the largest single price risk.

The management of cash assets and investment activities is carried out in accordance with the investment policy approved by the board, and matters related to investment activities are handled by the foundation’s finance committee.

The investment activities and risk management of the Asipex Group follow the investment policy approved by the company’s board, which is in line with the investment policy of the Jane and Aatos Erkko Foundation described above.

Communications

During the fiscal year, the foundation’s overall appearance was revamped. Along with this, new websites were launched, which serve as the foundation’s primary communication channel. Changes to the structure and content aimed to improve information accessibility and general user experience. The website provides information about the foundation’s activities, rules, strategic guidelines, decision making bodies, and awarded grants. It also publishes the annual report and financial statements.

Application guidelines and instructions for grant recipients and financial managers were refined and clarified.

The foundation also communicated by publishing an electronic newsletter and media release four times throughout the year, coinciding with the foundation’s board’s grant decision meetings. Six broader articles were produced during the year, addressing current themes in the foundation’s grant activities. This year, the communication emphasized the foundation’s strategic direction to increase support for technical fields alongside the already strong support for medical sciences. Articles, press releases, and news as needed are available on the website and additionally in the foundation’s ePressi news room.

Awarded grants are published on the website as soon as possible after the meetings. The names of external experts and the grounds for grant approval or rejection are not disclosed.

In late 2023, as part of the joint Brain Import program with the Finnish Medical Foundation, the Sigrid Jusélius Foundation, and the Jane and Aatos Erkko Foundation, a unique visual identity and website were created, along with articles, press releases, newsletters, and news updates.

An essential part of the foundation’s communication involves personal meetings and presentations. For instance, the foundation participated in a university tour coordinated by the Association of Finnish Foundations, visiting various universities in Finland throughout the year. This tour will continue in 2024.

Data protection and document management

When submitting applications for funding or reports to the Jane and Aatos Erkko Foundation, the applicants and grantees disclose personal information on themselves and potentially other members of their team, which creates a personal data file to be managed by the Foundation. The Foundation has used its best efforts to put in place a transparent procedure in which the rights of the applicants and grantees are duly taken into account as required under the Data Protection Act.

Administration

The Annual General Meeting held on 27 March 2023 appointed Nils Ittonen Chair of the Board and Juhani Mäkinen Deputy Chair.

Marianne Heikkilä, Reetta Meriläinen, Mikko Mursula, Jussi Pesonen, Sari Pohjonen, Kerstin Rinne and Antti Vasara were appointed members of the Board. Outi Vaarala and Anna Valtonen were appointed deputy members.

The term of every board member ends at the following General Annual Meeting. The Board convened five times during the reporting period. Foundation matters are also processed outside meetings.

At the General Annual Meeting, the Board appointed Mikko Mursula Chair of the Financial Committee with Nils Ittonen, Hanna-Mari Peltomäki and Karl Tujulin nominated as members.

The Financial Committee monitors the financial market and general economic developments acting within the framework of the investment strategy adopted by the Board. The Financial Committee convened four times during the reporting period.

At the General Annual Meeting, the Board appointed Nils Ittonen Chair of the Working Committee, while Juhani Mäkinen and Hanna-Mari Peltomäki were appointed members.

The Working Committee prepares matters for presentation to the Board. The Working Committee convened four times during the reporting period.

At the General Annual Meeting, the Board appointed Antti Vasara Chair of the Expert Committee, while Nils Ittonen and Hanna-Mari Peltomäki were appointed members.

The Expert Committee is convened when necessary to deal with the matters to be addressed. The matters presented to the Expert Committee are prepared by teams of specialists appointed for the specific fields. The names of the experts are not disclosed.

The processing of applications is based on peer review. Reviewers are experts from various fields, and they also contribute to other developmental work that promotes the foundation’s grant activities. The foundation appoints experts for each strategic period, but their names are not made public. Potential conflicts of interest are taken into account during the evaluation process.

During the fiscal year, the foundation appointed experts for the next strategy period 2024–26. Throughout the year, tools and processes for evaluation were developed by leveraging this expertise. A key success factor for the foundation is its high-quality evaluation process.

The Jane and Aatos Erkko Foundation is a member of the Association of Finnish Foundations. The purpose of the Association is to look after the common interests of Finnish grant foundations, funds and societies as well as to promote and develop corporate governance practices and professional skills.

Secretary-General Hanna-Mari Peltomäki is currently serving on the Board of the Association of Finnish Foundation (2023–25).

During the reporting period, the Foundation employed an average of eight people of whom four worked for the subsidiary group.

The key success drivers in the Foundation’s operations are a qualified and motivated staff, a committed Board and an extensive network of collaboration partners.

At its Annual General Meeting of 27 March 2023, the Foundation Board appointed PricewaterhouseCoopers Oy as the auditor of the Foundation’s accounts, with Valtteri Helenius, APA, serving as the auditor-in-charge. As a result of staff changes at PWC Oy, Tiina Puukkoniemi, APA, was appointed the auditor-in-charge in January 2024.

Activities in the current year

At the strategy meeting held on November 3, 2023, the foundation’s board outlined the grant policy objectives for the 2024–26 period. The foundation pursues its mission by supporting internationally competitive science, art, and culture. Grants will be awarded to research in medicine, technology, and natural sciences supporting technology, as well as art and culture. Special attention will be given to clearly identifying career stages, fostering innovation in scientific research, and promoting transformative and empowering models and content in art and cultural activities. A study on the state of economic research will also be conducted.

The main operational goals for 2024 include further strengthening the ways and processes for utilizing the foundation’s expertise and enhancing the understanding of the operational environment. Projects to be initiated and continued during the year in support of the grant policy include defining responsibility, including risk management, and defining information management or strategy, including the controlled development of tools.

Regarding communication, the goal is to strengthen the foundation’s recognition and attractiveness among the right target groups. Efforts will focus on targeted communication for specific groups, content production about objectives and the operational environment, enhancing interaction, and actively updating website guidelines and content. Communication activities will be evaluated, and their impacts will be measured.

Income statement

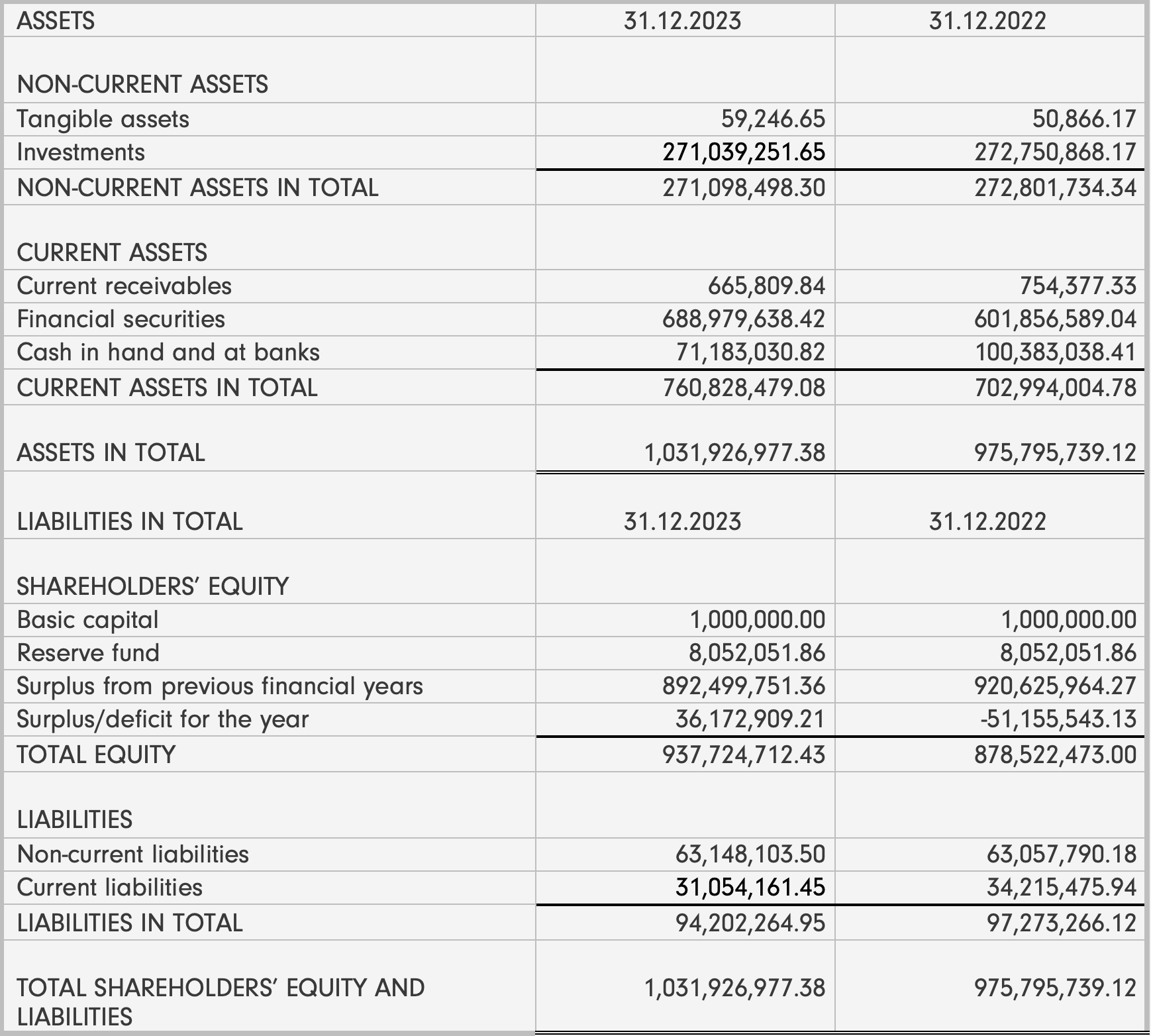

Balance sheet